By

Paul Johnson

Dec 17, 2025

Top 5 Payment API Solutions for Influencer & Affiliate Platforms: The Complete 2026 Guide

Who's This Guide For?

This guide is specifically written for the Founder, CTO, or Head of Finance of:

Influencer Marketing Platforms (IMPs) and Marketplaces

Affiliate Network and Partner Program Platforms

Vertical SaaS Solutions that facilitate payouts to creators, freelancers, and large vendor networks.

If you are tasked with making a critical technology decision on payment infrastructure, minimizing engineering lift, reducing compliance risk, and lowering your total cost of operations for global payouts, this is your essential reading.

Table of Contents

The Critical Challenge of Influencer Payments

Why payments are a complex operational challenge and an introduction to the top influencer payment solutions for 2026.

The True Cost of Payment Infrastructure

The Strategic Advantage of Modern Solutions with an analysis into the hidden costs of general payout solutions (Engineering Lift, Compliance, FX).

Essential Capabilities: What to Evaluate

The core considerations: Compliance, Tax Management & Liability (1099s, KYB/KYC), Funding, Pay-Out Methods, Global Reach, Security, Certifications (SOC 2), and Integration Needs.

In-Depth Platform Analysis: The Top 5 Solutions

Lumanu: The Payments Master Vendor Solution (Master Vendor Model).

Stripe Connect: The Developer's Toolkit (Customizability vs. Liability).

Tipalti: The AP Automation Giant (Enterprise Finance Focus).

PayPal Payouts: The "Consumer" Wallet (Global Wallet Reach).

Wise: The International Specialist (Best FX Rates).

Operational Comparison: Total Cost & Engineering Lift

Feature comparison table and deeper analysis of hidden costs.

The Lumanu Advantage: Wallet Architecture & Liability Shield

Why the "Master Vendor" and "Wallet" models significantly reduce risk and support for "In the Flow" vs. "Out of the Flow" funds management.

Implementation, Best Practices, and Framework

How to minimize time to market and engineering investment using a decision matrix approach with assessment criteria.

Frequently Asked Questions (FAQ)

Conclusion

Managing payments to influencers and affiliates has become one of the most complex operational challenges facing platforms and marketplaces. Payments are a critical part of workflows for influencer campaigns and affiliate programs. Platforms supporting in this space need to find the right solution to support continued growth while solving for vendor onboarding, compliance, tax, handling potential error states, and importantly minimizing engineering lift and support costs.

In 2026, the top payment platforms to support payouts for platforms include: Lumanu, Wise, Stripe Connect, Tipalti, and PayPal Payouts.

The best payment solutions combine robust compliance features including automated 1099 handling, global pay-in and pay-out capabilities, enterprise-grade security certifications, and transactional fees that scale with usage.

This comprehensive guide examines the leading payment solutions to support influencer & affiliate payouts, and analyzes their features, costs, compliance capabilities, and suitability for different scenarios. Understanding these platform differences is important to make the best decision for managing payments at scale and ensuring regulatory compliance.

Why Choosing the Right Payment Solution for your Influencer & Affiliate Platform Matters

The creator and affiliate payment landscape has evolved. It is easy to send money, but paying individuals at scale introduces friction around:

KYC/KYB: Verifying identities to prevent fraud.

Tax Compliance: Managing the mix of W-9s, W-8BENs, 1099-NECs, and 1099-Ks.

Support Costs: Dealing with "Where is my money?" tickets.

Operational Costs: Managing error states during vendor onboarding, fund transfers, INTL payouts, etc.

The Hidden Costs of Generic Payment Infrastructure

Companies using overly generic or inadequate payment systems often encounter “hidden” expenses that can increase the total cost of ownership

These include:

Engineering Lift: Building role based access controls, funding (invoicing), support for INTL payments, UI for onboarding, and handling various error states.

Support costs: Tracking down payment statuses, updating vendor records and reconciling payouts can lead to hours of time spent across teams

Compliance penalties: IRS fines for improper 1099 reporting can reach $50-$280 per form

Administrative overhead: Manual vendor onboarding and payment processing can result in hidden costs of $700-$1000 per vendor

Foreign exchange losses: Poor FX rates can add 3-7% to international payments

The Strategic Advantage of Modern Payment Solutions

Leading solutions have transformed from simple payment processors into comprehensive solutions that include compliance and support. They offer:

Intuitive vendor onboarding and self service account management

Automated compliance workflows that reduce legal risk

Streamlined implementation that minimize engineering investment

Support for platforms who are “in” or “out” of the money flow

Built in capabilities to easily manage account funding

Integrated reporting that simplifies financial reconciliation

Global payment capabilities that enable international partnerships and payments from various source currencies

Key Capabilities to Evaluate for Payment Solutions

Compliance and Tax Management

Modern businesses require platforms that handle the complex regulatory landscape automatically. Essential compliance features include:

Automated 1099 Generation: Platforms should automatically generate, distribute, and file 1099-NEC forms for U.S. vendors earning over $600 annually. This eliminates manual tracking and reduces filing errors.

International Tax Compliance: For global operations, platforms must navigate varying tax treaties, withholding requirements, and reporting obligations across different jurisdictions.

Lightweight KYB/ KYC: Ensure that you are paying who you think you are paying and that the individual or business is not on any sanctions list (AML/ OFAC screening). Optional checks for adverse media and brand safety.

“Pay-in” Account funding and management

The ability to easily fund account(s) in different currencies and the ability to run reconciliation. Leading platforms support:

Process to fund accounts from platform funds or directly from platform customers

Configurable and compliant invoicing to support AP workflows (customizable based on AP requirements)

Segregated funds in dedicated accounts with running balance and full ledger

Team level budgets and workflows to support companies with different budgets (e.g. influencer, affiliate, social teams)

“Pay-Out” Methods and Global Reach

The ability to pay vendors through their preferred methods significantly impacts satisfaction and retention. Leading platforms support:

Bank transfers in 100+ countries

Local to local payments to reduce fees

Digital wallets including PayPal payouts

Push to card payouts for instant payouts

Security and Certifications

Enterprise-grade security is non-negotiable when handling vendor payments and sensitive business data. Look for platforms with:

SOC 2 Type II certification for operational security controls

ISO 27001 compliance for information security management

Bank-level encryption for data transmission and storage

GDPR compliance for payouts across the EU

Integration Capabilities

Modern payment platforms must integrate seamlessly with existing business systems to maximize efficiency. Key integration features include:

API access for custom workflow automation

Easy vendor onboarding without the need to manage states and errors

Project management tools like custom built platforms, Asana, Airtable, Monday.com

Web hooks to support CRM for unified vendor relationship management

Accounting software integration with QuickBooks, Xero, and NetSuite

Client and Payee Support

Dedicated support teams to handle any potential time sensitive issues that come up. Look for platforms with:

Pre-sales support to help drive adoption of payments and “stickiness” for your platform

Commitment to your platform to address product enhancements and needs

Ongoing dedicated support for your customers and influencer & affiliates

Direct banking relationships to quickly investigate and resolve any banking issues

Detailed Analysis: The Top 6 Payment Solutions for Influencer & Affiliate Platforms

1. Lumanu: The Payments Master Vendor Solution

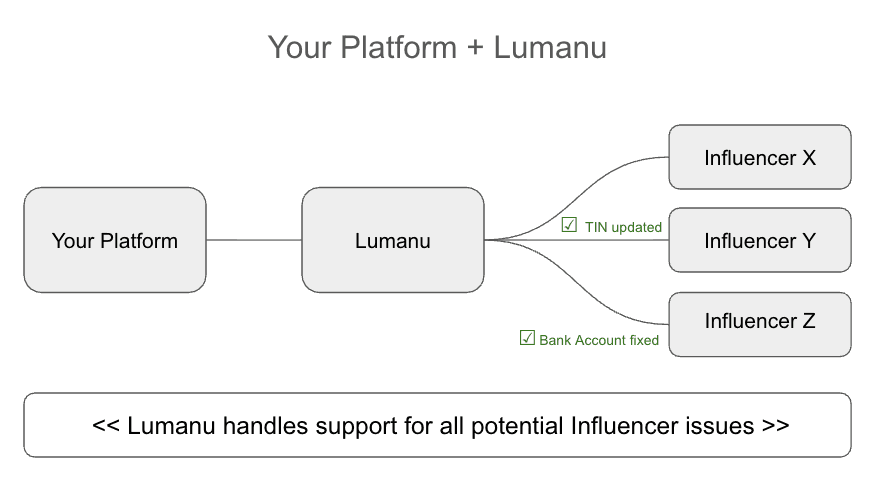

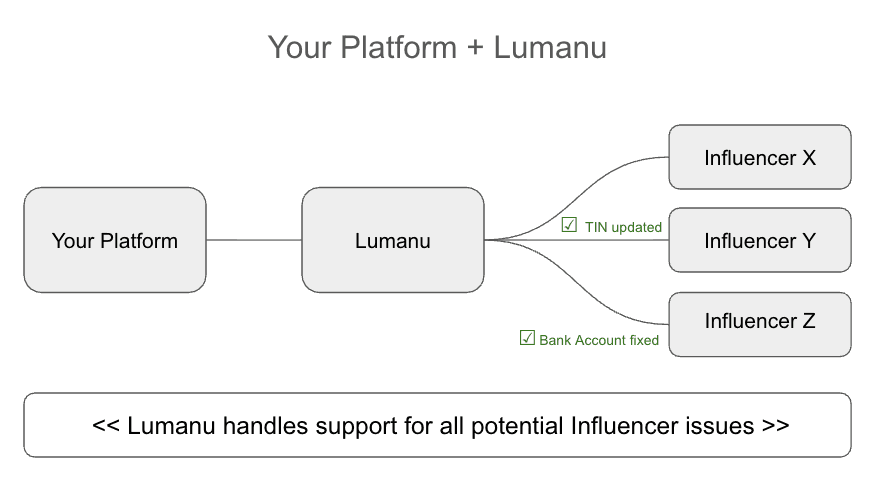

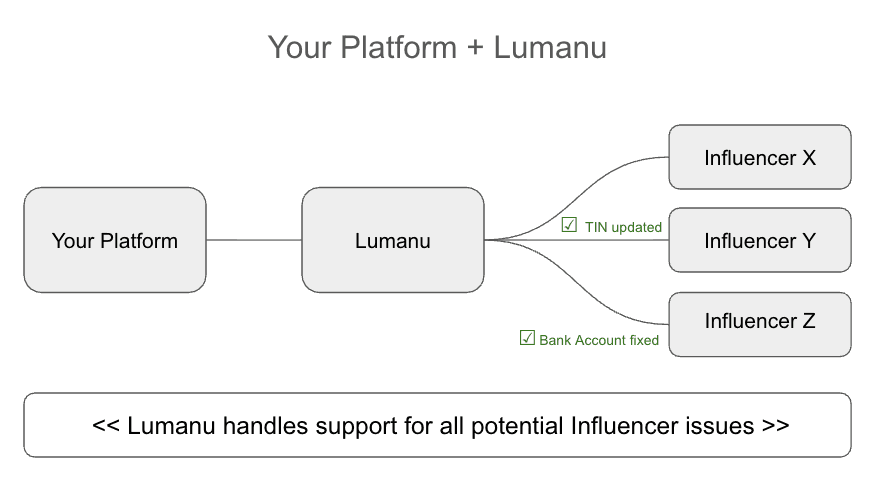

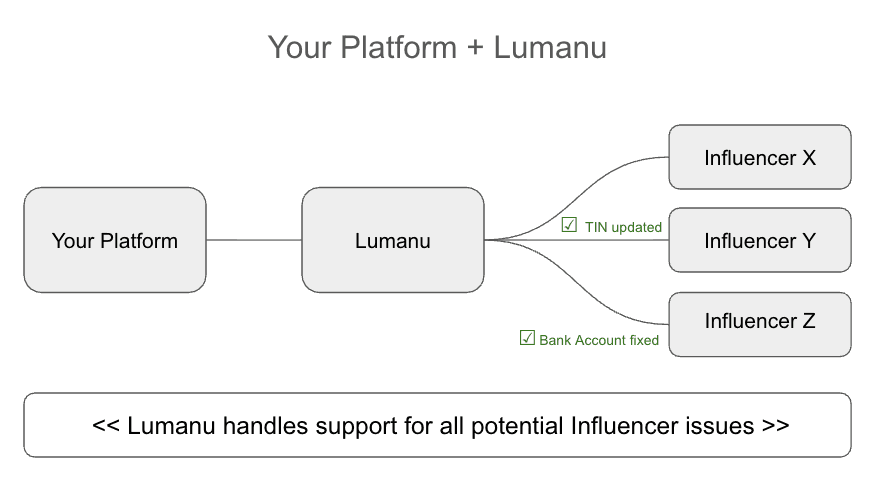

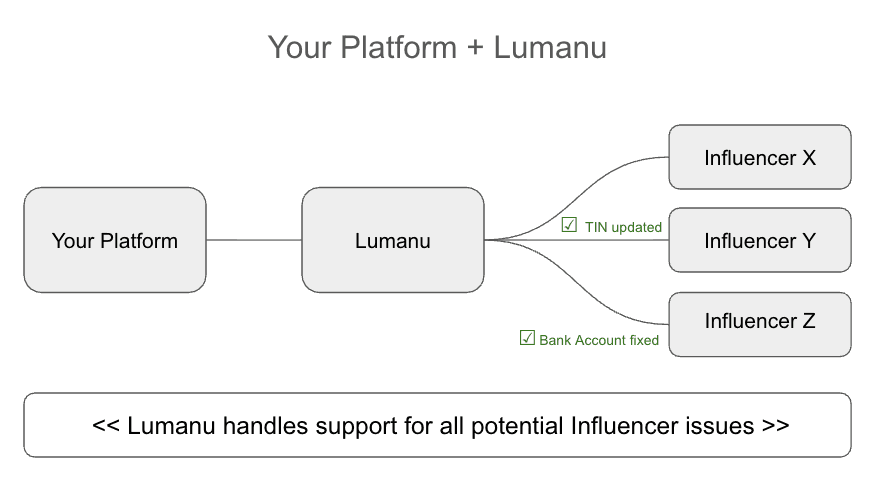

Lumanu stands out as a solution purpose built to support payments in the creator economy, including influencer marketing and affiliate commissions. Lumanu acts as a single vendor to handle onboarding and compliance for influencers and affiliates verticals, not just a payment processor. By acting as your Master Vendor, Lumanu sits between you and your thousands of creators, absorbing the compliance requirement and liability that usually falls on the platform. Vendors only have to sign up for one Lumanu account which enables them to receive payment from all platforms, agencies and brands using Lumanu.

Best For: Platforms, Marketplaces, Agencies, and Large Enterprise Brands that want to completely offload compliance liability (1099s, W-9s) and minimize engineering lift.

Key Strengths:

Single-vendor-of-record model: eliminates the need for individual vendor agreements and setting up vendors in your systems.

Liability Shield: Lumanu absorbs the liability for W-9 collection, compliance screening, and tax filing so your internal teams do not have to manage these risks.

Zero-friction onboarding: Gives creators a seamless onboarding experience that is purpose-built for individuals and talent management, not complex corporate suppliers.

Low engineering lift: Requires minimal dev resources and code to integrate compared to building custom flows with Stripe or other solutions.

White glove, dedicated support: Provides personalized support for platforms and agency/ enterprise clients and dedicated support to influencers and creators.

Limitations:

Less customization for vendor experience: The onboarding flow is optimized for ease and completions but is less "pixel-perfect" customized when compared to building your own from scratch on Stripe Connect.

Account approval process for SMBs: As a risk-bearing partner, Lumanu may vet SMBs more closely than a generic open API like PayPal.

Funding methods designed for B2B payments: In contrast to Stripe which accepts and processes credit cards, Lumanu supports payments from businesses via ACH and Wire to fund dedicated accounts and send payouts to influencers and affiliates. If you wish to accept credit card payment you would need that additional solution.

Pricing: Transparent and Simple All-In Pricing. Typically a small percentage per payout. No hidden costs for active users, tax modules, different payment rails, FX conversions, or payee KYC/KYB and screenings.

2. PayPal Payouts: The "Consumer" Wallet

PayPal is often chosen because of its global ubiquity, but it operates as a "closed garden" wallet ecosystem for payouts rather than an actual vendor management platform.

Best For: Early-stage startups, one-off marketing campaigns, or micro-payments where collecting vendor information such as bank details adds too much friction.

Key Strengths:

Wide adoption: Most everyone already has a PayPal account, meaning close to zero onboarding friction for recipients.

Global reach: Supports sending funds to 200+ markets instantly without needing bank routing numbers.

Minimal Technical Complexity: The Payouts API is widely considered one of the simplest integrations for developers to implement for basic money movement.

Limitations:

Lack of support: Requests taking days, weeks or longer to get answers and resolutions to.

Operational Continuity Risk: Real risk to operations as PayPal is infamous for freezing business accounts without warning due to "suspicious activity" algorithms, potentially halting your entire payout run.

Reconciliation and ledger complications: Tax and payment data lives inside PayPal, not your systems, making reconciliation difficult. The API was not built to support reporting needs.

Zero support for non-PayPal users: if the influencer/ creator/ affiliate/ talent management company/ etc. does not have a PayPal account or will not accept PayPal for payments, you will need to have an alternative way to make these payments. These exceptions mean you will ALWAYS need a “fallback” solution if going with PayPal.

Potential Hidden Costs for Recipients: When working with creators outside of your country, they effectively earn less because of unfavorable foreign exchange rates when moving funds from their PayPal wallet to their actual bank account.

Pricing: Transaction Fee + Spread. Domestic payouts cost roughly 2% (capped), but international payments often include a 3-7% currency conversion spread buried in the exchange rate.

3. Stripe Connect: The Developer's Toolkit

Stripe Connect is the industry standard infrastructure for building complex marketplaces, offering powerful APIs but requiring significant internal resources to build and maintain.

Best For: Engineering-led teams building highly custom, complex payment flows (e.g., splitting payments 3 ways) who want total control over the UI.

Key Strengths:

Infinite Customizability: You can build virtually any payment flow, UI, or funds-splitting logic imaginable if you have the engineering resources to support a custom build.

Unified Card Processing and Payouts: The platform is excellent for marketplaces that need to both accept credit card payments from users and pay creators within the same financial ecosystem.

World-Class Documentation: Developers benefit from industry-leading API documentation and tooling, which can speed up the initial "Hello World" integration.

Limitations:

Complex Fee Structures: Stripe employs a "nickel and dime" approach where you pay separately for active accounts, per-payout fees, 1099 filing fees, identity verification, and instant payout surcharges. Not only are these fees not always transparent, they can also vary over time leading to unpredictable costs for certain markets and compliance requirements.

Retained Vendor Liability: Despite using their software, your company generally remains the Merchant of Record, meaning you retain the full legal liability for sanctions screening and tax compliance failures.

High Ongoing Maintenance: A custom Stripe integration requires significant ongoing engineering maintenance to handle edge cases, banking error states, and evolving compliance rules.

Global coverage/ International Payments: Strip has some unexpected country specific limitations (vendors unable to create Stripe accounts) so make sure that the specific payout countries you require are supported.

Pricing: Complex Variable Pricing. Monthly fees per active user + per-transaction fees + 1099 filing fees + FX per payment and % based fees.

4. Tipalti: The AP Automation Giant

Tipalti is a heavyweight Accounts Payable solution designed for traditional corporate finance teams processing thousands of invoices. In recent years, Tipalti’s “Mass Pay” capability does support bulk payouts using CSV files and API calls as an effort to win more platforms and marketplaces.

Best For: Mature Enterprise finance departments that treat creators like traditional suppliers and prioritize ERP integration (NetSuite/Oracle) over creator experience.

Key Strengths:

Deep ERP Integration: The platform offers robust, bi-directional synchronization with enterprise accounting systems like NetSuite, Intacct, and QuickBooks for automated reconciliation.

Advanced Fraud Protection: Finance teams benefit from "Payee Monitoring" features that help detect duplicate invoices or fraudulent vendors before payments are released.

Mass Global Batching: The infrastructure is capable of handling tens of thousands of line items in a single batch file, making it suitable for massive, traditional AP runs.

Limitations:

Clunky Vendor Portal: The onboarding interface is formal, complex, and not optimized for mobile-first creators, which often leads to confusion and high drop-off rates during enrollment.

Heavy Implementation: The integration process can take weeks or months to finalize, making it an "overkill" solution for agile software platforms that need to move fast.

High Cost of Entry: Tipalti is generally the most expensive option in the market, with high platform minimums that often price out growth-stage companies.

Pricing: Enterprise Custom. High monthly platform fee (often $1k+) plus per-transaction costs.

5. Wise: The International Specialist

Wise (formerly TransferWise) is a "money mover" known for transparency, but requires significant engineering resources to build and maintain vendor onboarding, handling error states and failed payments and ledger management.

Best For: Smaller agencies or platforms making low-volume international transfers where getting the absolute best exchange rate is the only priority.

Key Strengths:

Transparent Exchange Rates for Payors: Wise uses the mid-market exchange rate and clearly displays their fee, often resulting in costs that are 3-5% cheaper than traditional banks.

Speed of Transfer: The network is optimized for velocity, with many international transfers arriving instantly or within hours rather than days.

Ease of Setup: It is incredibly easy to set up a business account and start sending money immediately without a complex sales or integration process.

Limitations:

Unclear Exchange Rates for Creators: When you set up a recipient to receive a payment in a different currency the funds will just hit their bank account. This can lead to confusion and support costs

Absence of Compliance Layer: Wise is strictly a money movement tool; it does not collect W-9s, file 1099s, or validate vendor identities for tax purposes.

Manual Data Management and Reconciliation: Using Wise at scale requires significant manual work (or a custom API build) to track exactly who has been paid for year-end tax reporting and reconciliation. Because rates float and there may be fixed fees that can vary, it is very difficult to reconcile what you expect to send versus what you actually pay.

Unpredictable Account Limits: Business accounts can be subject to volume limits or freezes if sudden high-volume payout activity occurs, as the system is not designed for mass-payout orchestration.

Pricing: Pay-As-You-Go. Fixed fee (e.g., $0.50) + variable fee (e.g., 0.43%) per transfer.

Operational Comparison: Capabilities & Engineering Lift

Instead of looking at just transaction fees—which can be misleading—founders should look at the Total Cost of Operations.

Feature / Capability | Lumanu | PayPal Payouts | Stripe Connect | Tipalti | Wise |

Vendor onboarding and compliance | Yes. Fully handles out of the box and takes on all compliance | No | Yes. Gives you the building blocks to setup onboarding and compliance. Platform must manage all states. | Yes. Provides rigid onboarding flow. Your platform must manage support. | No |

Tax Filing | Lumanu files 1099 | PayPal files 1099-K | Platform files (via Stripe Tax) | Platform files | Platform files |

Liability Shield | High (Lumanu is legal vendor) | Medium (PayPal owns K, you own relationship) | Low | Low | Low |

Creator Experience | Seamless and unified. Purpose built for creators | PayPal experience | Mixed (must have Stripe account) | Enterprise grade but difficult | Standard |

Engineering Lift | Low | Low (Simple API) | High (Custom Build) | Medium/High | Medium |

Pricing Model | Simple, All-in transaction based pricing | Tx Fee + FX + Spread | Complex (Per cap + %) | High SaaS + Tx | SaaS + Tx + FX |

Hidden Costs to Consider

Compliance Management: Manual 1099 preparation and filing can cost $25-$50 per form when outsourced to accounting firms. Platforms with automated compliance can save thousands annually for businesses with large vendor networks.

Foreign Exchange Margins: Traditional banks and some payment platforms add 2-5% margins to currency conversions. Over time, these margins can exceed transaction fees for international payments.

Administrative Overhead: Manual vendor onboarding, payment processing, and record-keeping can consume 2-5 hours per vendor monthly. Automated platforms reduce this to minutes, representing significant labor cost savings.

Integration and Setup Costs: While some platforms offer free setup, enterprise implementations may require custom integration work costing $10,000-$50,000 for complex workflows.

Exception Handling: When payments fail, a certain country is not available to send funds to, or vendors enter incorrect banking details, the true time and cost to resolve the issue can take hours of time and context switching across the team. Manual error state management, including handling failed webhooks, rejected ACH/wire transfers, and banking delays, consumes valuable engineering time and can lead to frustrated customers and influencers.

Support Costs: High volumes of "Where is my money?" tickets due to payment delays, FX confusion, or clunky vendor portals create a heavy burden. Dealing with payment status inquiries, updating vendor records, and manual reconciliation can consume hours of time across customer support and finance teams, significantly increasing your overall Total Cost of Operations. Platforms with dedicated vendor support and seamless user experiences can reduce these support tickets drastically.

Fraud risk: There has been a spike in hacked email accounts of influencers and affiliates with bad actors attempting to divert funds paid by platforms to different bank accounts. Platforms with strong ID verification onboarding flows, 2FA and other security measure (e.g. IP monitoring) can help protect against siphoned funds.

Why Lumanu is Different

1) The "Master Vendor" Advantage

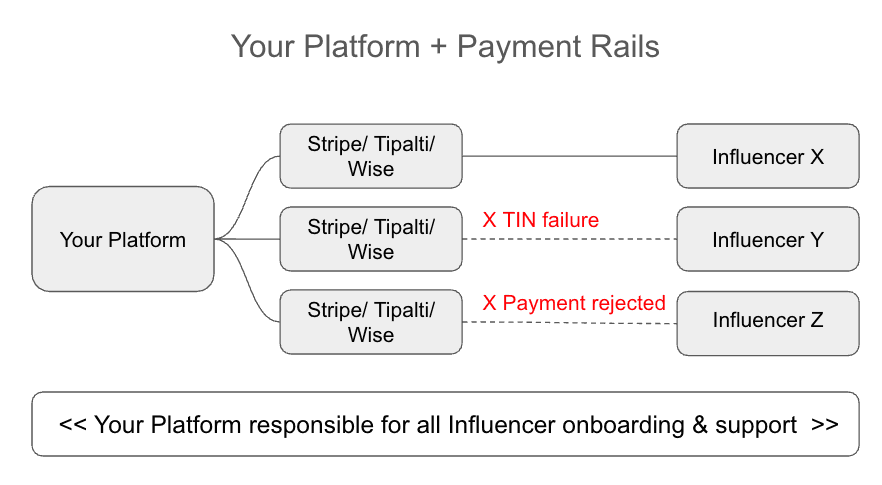

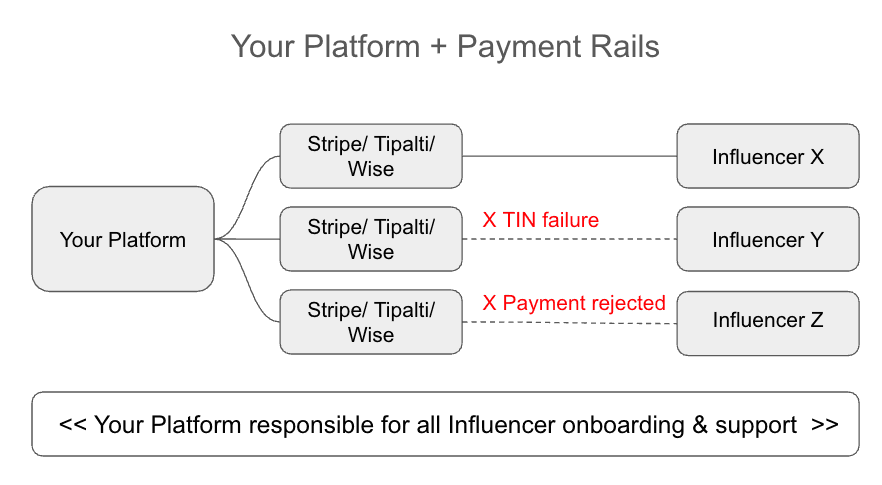

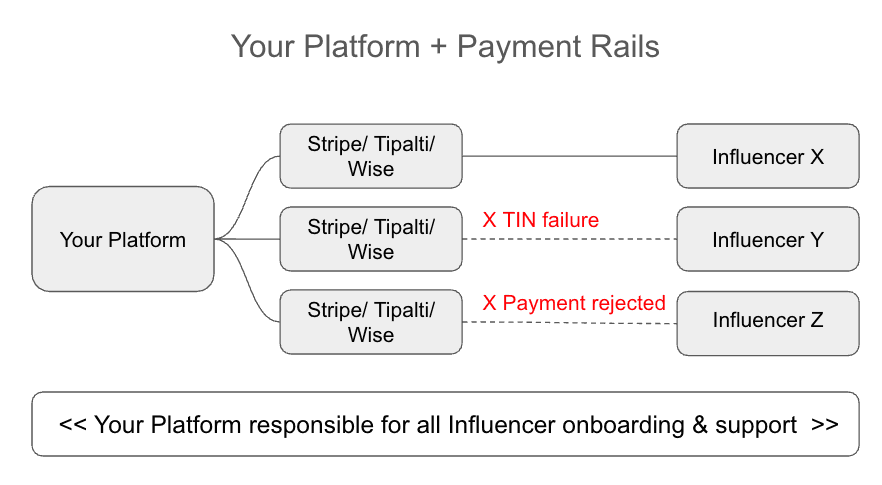

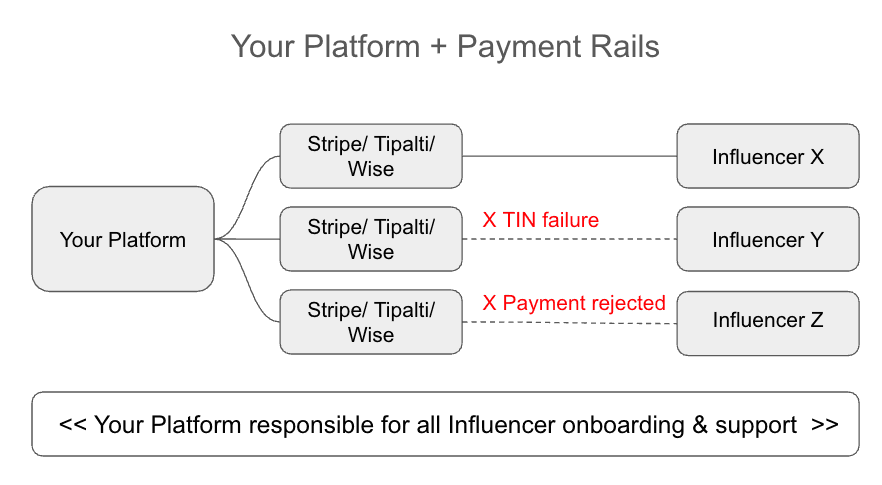

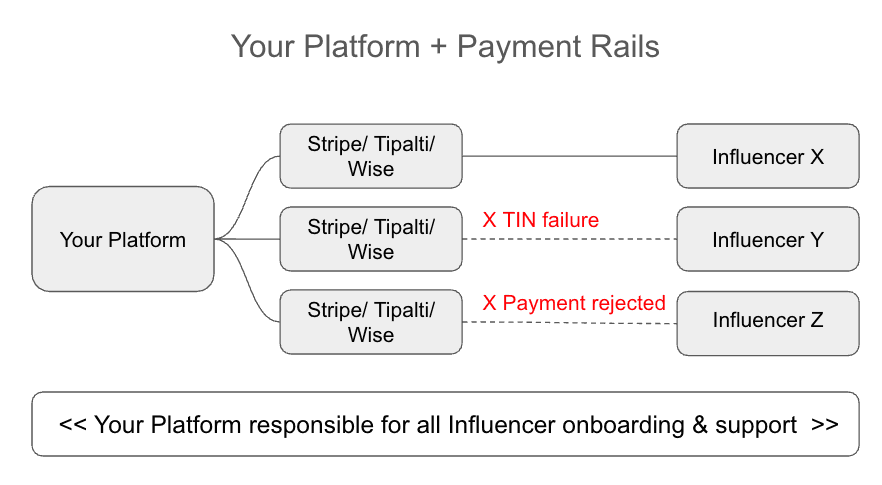

Most platforms (Stripe, Wise, Tipalti) function as Software & Rails. You are still the legal merchant for every creator you pay. This means:

Liability: If a creator is on a sanctions list (OFAC), you are liable.

Support: When a bank transfer fails, your team has to debug it.

Tax: You are responsible for the accuracy of every W-9.

Lumanu acts as your Single Vendor. When you pay through Lumanu, you pay Lumanu. We then distribute funds to the creators.

For Finance: You deal with 1 vendor instead of 10,000.

For Tech: You integrate one endpoint. We handle the banking error states, the KYC failures, and the tax data updates.

For Creators: They get a single, clean 1099 at the end of the year.

2) The "Wallet Advantage"

One underestimated challenge in building a payout capability is Ledgering. If you use a traditional processor or AP solution (Stripe Connect, Wise, Tipalti, PayPal) your platform is responsible for tracking every penny. You must build a system that manages: "Customer A has $50 pending, $10 available, and $5 in transit."

The Risk: If your internal ledger falls out of sync with the actual bank balance (due to a failed web hook, a refund, or a currency fluctuation), you are liable for the difference.

The Lumanu Solution: Lumanu provides a Creator Wallet architecture. We act as the ledger. You simply instruct us to "Pay Creator A $500," and the funds move into their Lumanu Wallet.

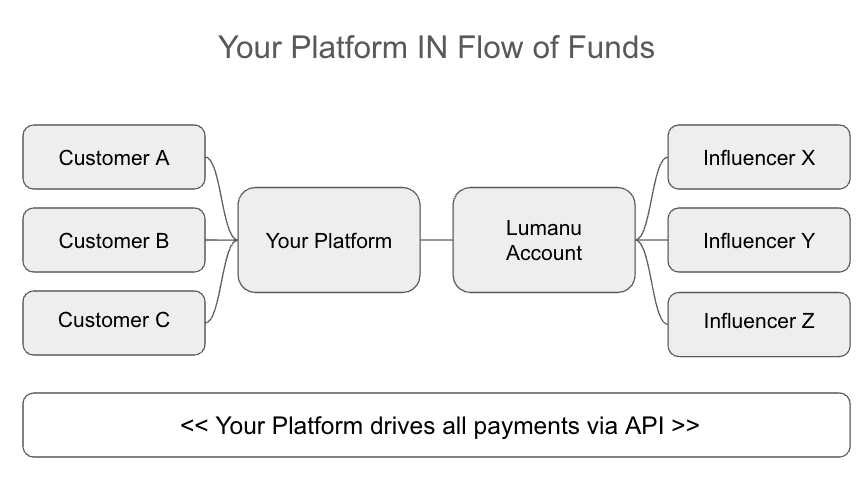

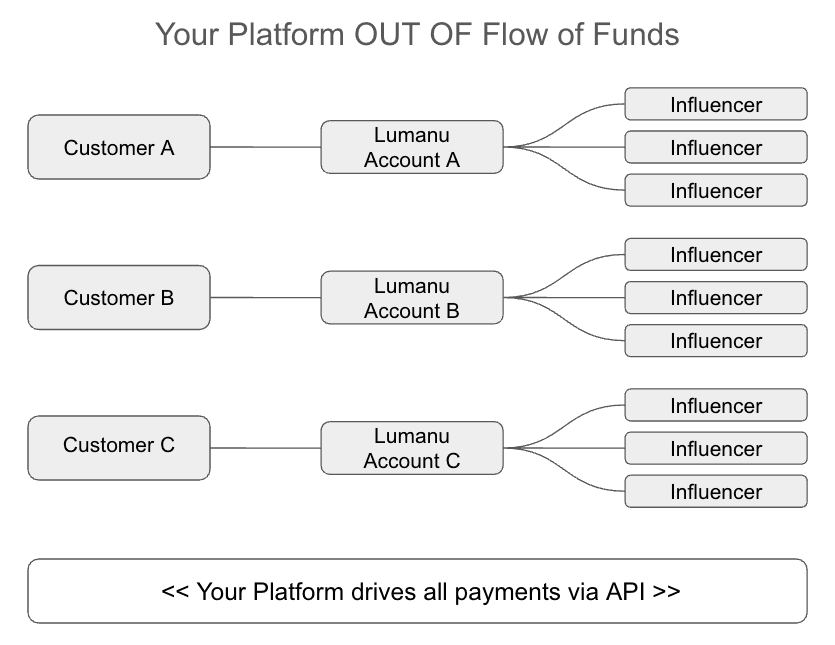

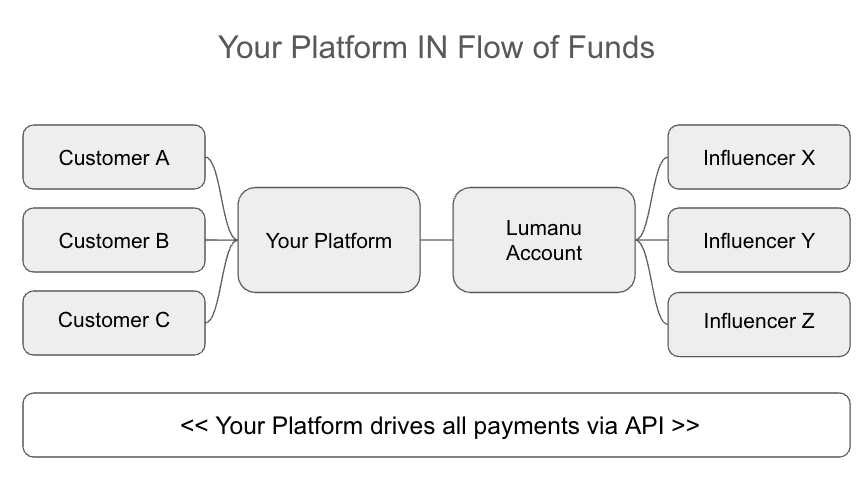

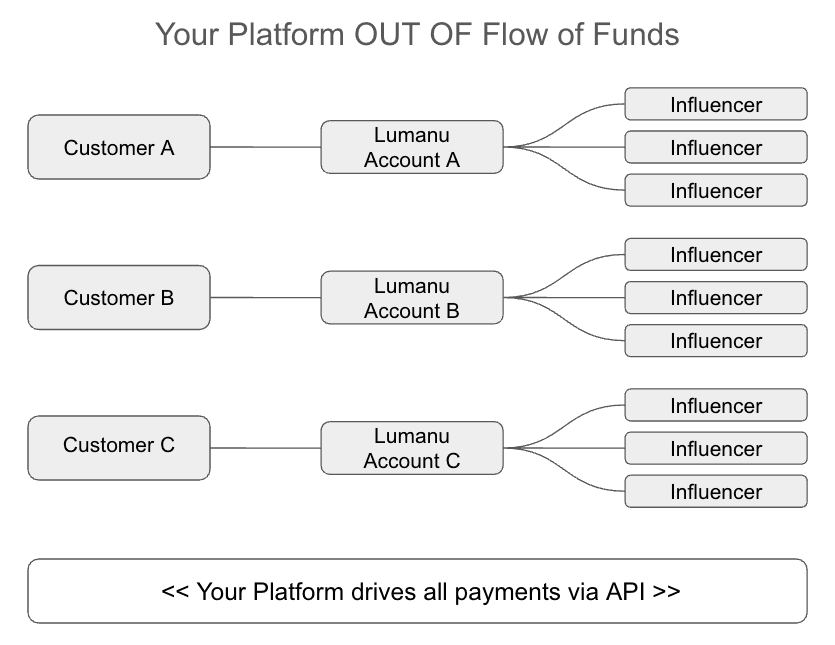

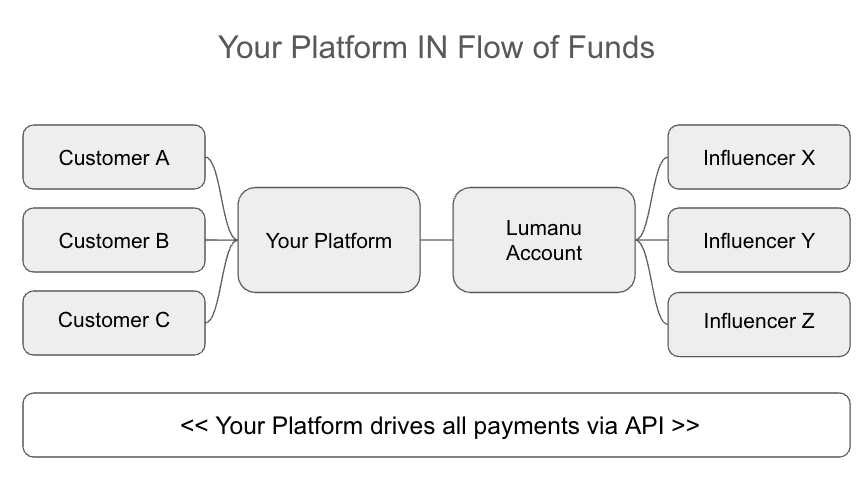

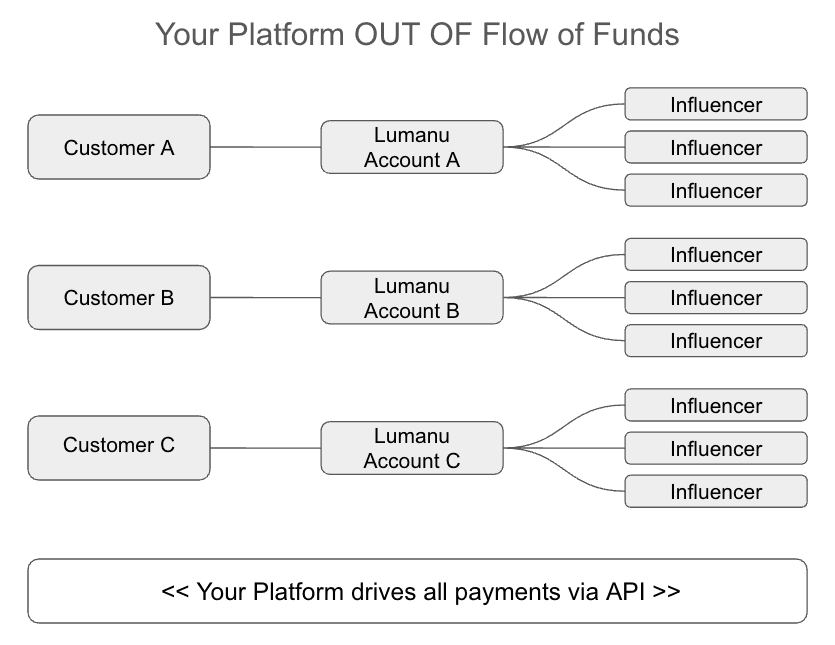

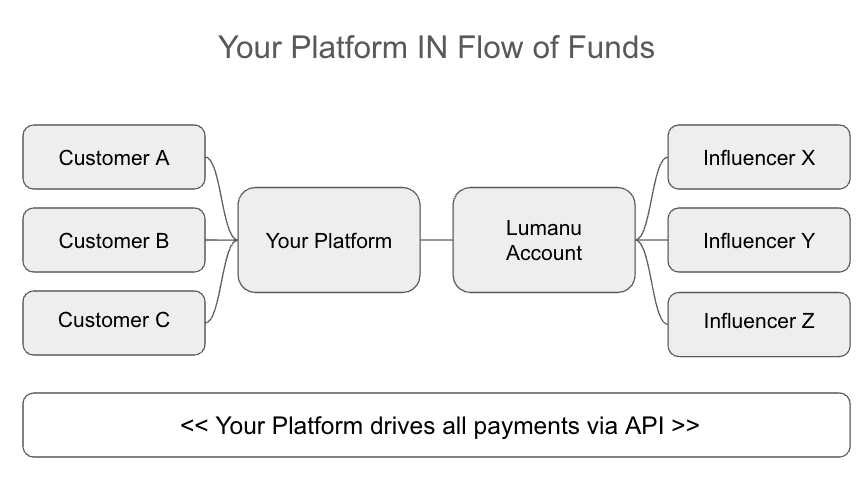

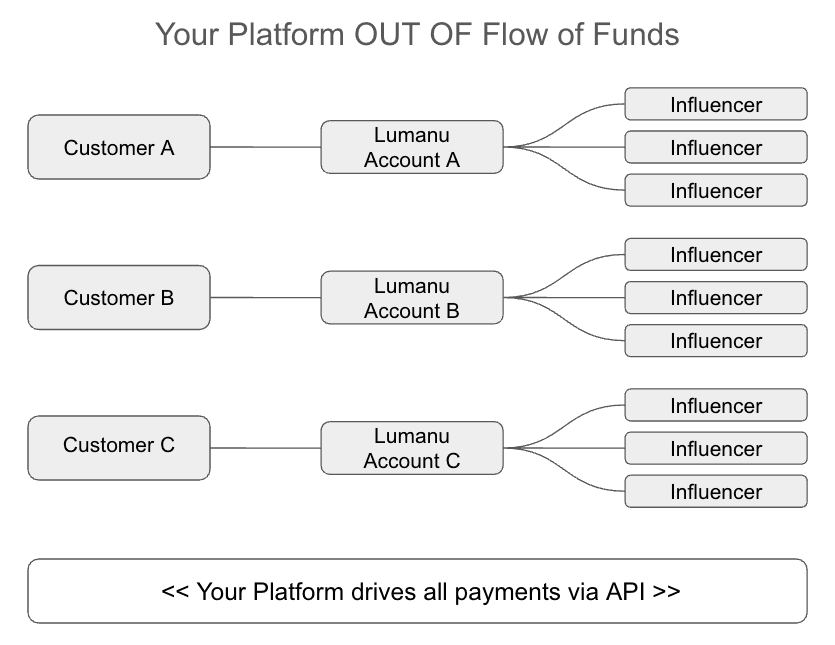

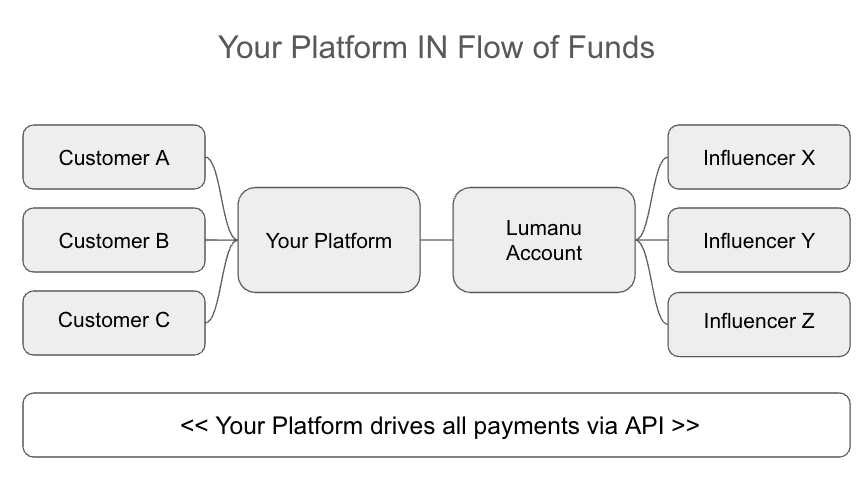

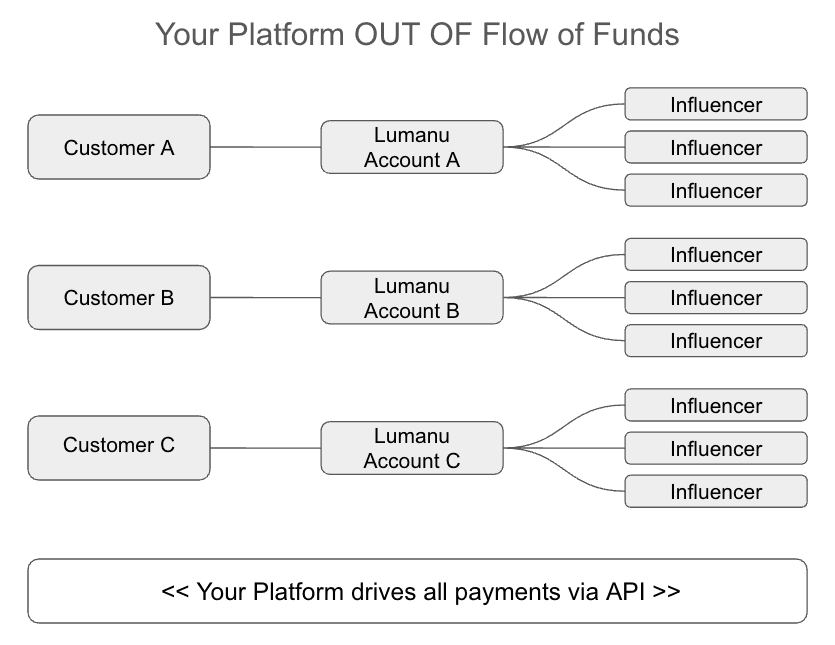

Flexible Funds Flow: In or Out? Because Lumanu uses this Wallet architecture, we support flexible workflows that other providers cannot:

In the Flow of Funds: You fund your Platform Lumanu Master Account Wallet as needed with bank transfers and compliant invoicing (often aligning with your customer funds). You then API-trigger payouts to thousands of Creator Wallets instantly. Lumanu supports custom fields to easily track payouts by customer ID and campaign.

Out of the Flow of Funds: You can have your brands or third parties pay Lumanu directly, each to a unique and segregated bank account. Your platform supports creating funding requests for your customers to “top off” funds. You never touch the money, removing you from the flow of funds entirely and significantly reducing your regulatory burden. Your platform manages payout workflow across your customers via dedicated supporting Lumanu accounts.

Why this matters: With Stripe, "holding" funds requires complex escrow licenses or "FBO" (For Benefit Of) accounts. With Lumanu, the money sits in the User's Wallet, not your platform's balance sheet.

Implementation Best Practices: Minimizing Time to Market and Implementation Engineering resources

Successful influencer payment platform implementation requires planning and attention to operational details that can significantly reduce time to market and potential decisions that lead to ongoing support costs.

Integration Planning

System Mapping: Document existing systems that need to integrate with the payment platform along with data flows. Include your platform along with any external systems like accounting software or project management tools.

Joint API Integration Plan: Work with your chosen partner to develop a shared integration plan along with open communication channels (e.g. Slack). Define clear deliverables and phases to move from design to sandbox to production.

Workflow Automation and Complexity Reduction: Identify opportunities to automate current manual processes through platform features and API integrations. Where possible reduce steps and complications from your existing process.

Onboarding Strategy

Phased Rollout: Implement the platform with a test campaign or customer first to identify and resolve issues before full deployment.

Training Programs: Provide training for internal teams (and potentially creators depending on onboarding flow) to ensure smooth adoption and minimize support requests.

Communication Planning: Develop clear communication about the transition, including timelines, benefits, and support resources.

Performance Monitoring

Key Metrics Tracking: Monitor payment processing times and late payments, vendor satisfaction scores, compliance accuracy, and cost per transaction.

Regular Reviews: Conduct quarterly reviews of platform performance against business objectives and vendor feedback.

Optimization Opportunities: Continuously identify ways to improve workflows and reduce costs through platform feature utilization.

Making the Right Choice: Platform Selection Framework

Selecting the optimal freelance payment platform requires a systematic evaluation of your specific business needs, constraints, and growth objectives.

Assessment Criteria

Payment Volume and Frequency: High-volume operations may benefit from platforms offering volume discounts.

Geographic Distribution: Businesses with concentrated regional vendor bases may prioritize platforms with strong local capabilities over global reach. Ensure that each region can be supported via siloed workspaces.

Integration Needs: Companies with sophisticated technology stacks require platforms with comprehensive API capabilities and pre-built integrations.

Growth Trajectory: Consider platforms that can scale with your business and add features as your needs evolve. Ability to influence the roadmap can go a long way to future proofing your business.

Client type: If your clients who pay you are enterprises, agencies, brands, consumers, etc impact who you should pick. For example if your clients are enterprise brands and agencies who need more robust controls, you will have to build that yourself because some payment tools like Stripe and PayPal and Tipalti do not support robust controls and separation of funds.

Decision Matrix Approach

Create a weighted scoring system that reflects your priorities:

Cost Structure (Weight: 20%): Total cost of ownership including fees, implementation, and administrative savings

Compliance Capabilities (Weight: 20%): Automation level, accuracy, and coverage of regulatory requirements

User Experience (Weight: 20%): Ease of use for both internal teams and vendors

Integration Capabilities (Weight: 10%): These are table stakes but API quality, pre-built integrations, and customization options should meet your requirements

Support and Reliability (Weight: 30%): Customer service quality, uptime, and issue resolution speed. Ensuring your partner can handle front line support when dealing with a large volume of influencer payouts is crucial, as is ensuring your payment infrastructure will b e available when your customers need it.

Frequently Asked Questions

What is the best way for platforms to manage influencer payouts?

The best method depends on your business size and needs, but leading platforms like Lumanu, Stripe Connect and Tipaliti offer secure, compliant solutions with global reach and varying degrees of tax compliance support.

Which payment solution is best for platforms paying international influencers?

Wise and PayPal excel at international payments with competitive exchange rates and broad global coverage, while Lumanu offers superior compliance automation for enterprise clients with international vendor networks.

Does a "Wallet" infrastructure help me if I want to avoid holding funds as a platform?

Yes, it is the best solution for that. Many marketplaces want to trigger payments without actually taking possession of the funds. Because Lumanu assigns a real, functional wallet to every customer and creator, you can route payments from your customers directly to creators. The funds land in your customer’s wallet which is a dedicated bank account, not a sub-account on your books. This allows you to orchestrate the transaction without being the custodian of the cash.

How do influencer payment solutions handle tax and compliance for platforms?

Most modern platforms help collect and validate information and assist with automatic 1099 generation for U.S. vendors. They also may handle international tax withholding requirements, and maintain documentation for compliance audits. If you work with a solution like Lumanu who is a master vendor, the solution will take all on all tax compliance so that you do not have to.

Are there payment solutions with low fees for influencers?

Wise offers the lowest fees for international transfers using mid-market exchange rates, while enterprise platforms like Lumanu do not charge fees to influencers and provide custom pricing that can be more cost-effective for high-volume operations.

What is the safest way to pay influencers via a payment solution?

Use platforms with SOC 2 Type II certification, bank-level encryption, and comprehensive insurance coverage. Lumanu, and other enterprise-grade platforms offer the highest security standards for business payments.

Conclusion: Choosing Your Ideal Influencer Payment Platform

The payment platform you choose to manage your influencer payouts will significantly impact your operational efficiency and ultimately your customer relationships. While cost considerations are very important, the total value equation must include compliance automation, security features, support, integration capabilities, and long-term scalability.

For platforms managing complex vendor networks, particularly in the creator economy and influencer marketing space, platforms like Lumanu offer the compliance, automation, and integration capabilities needed to scale operations efficiently while minimizing risk.

Partnering with a robust and purpose built payment platform pays dividends through reduced administrative overhead, improved compliance accuracy, enhanced influencer satisfaction, and the operational flexibility to focus on roadmap opportunities to win more customers without payment infrastructure constraints.

Ready to transform your payment operations with enterprise-grade compliance and automation? Request a Demo to see how Lumanu can streamline your influencer payment operations management while ensuring comprehensive compliance.

Who's This Guide For?

This guide is specifically written for the Founder, CTO, or Head of Finance of:

Influencer Marketing Platforms (IMPs) and Marketplaces

Affiliate Network and Partner Program Platforms

Vertical SaaS Solutions that facilitate payouts to creators, freelancers, and large vendor networks.

If you are tasked with making a critical technology decision on payment infrastructure, minimizing engineering lift, reducing compliance risk, and lowering your total cost of operations for global payouts, this is your essential reading.

Table of Contents

The Critical Challenge of Influencer Payments

Why payments are a complex operational challenge and an introduction to the top influencer payment solutions for 2026.

The True Cost of Payment Infrastructure

The Strategic Advantage of Modern Solutions with an analysis into the hidden costs of general payout solutions (Engineering Lift, Compliance, FX).

Essential Capabilities: What to Evaluate

The core considerations: Compliance, Tax Management & Liability (1099s, KYB/KYC), Funding, Pay-Out Methods, Global Reach, Security, Certifications (SOC 2), and Integration Needs.

In-Depth Platform Analysis: The Top 5 Solutions

Lumanu: The Payments Master Vendor Solution (Master Vendor Model).

Stripe Connect: The Developer's Toolkit (Customizability vs. Liability).

Tipalti: The AP Automation Giant (Enterprise Finance Focus).

PayPal Payouts: The "Consumer" Wallet (Global Wallet Reach).

Wise: The International Specialist (Best FX Rates).

Operational Comparison: Total Cost & Engineering Lift

Feature comparison table and deeper analysis of hidden costs.

The Lumanu Advantage: Wallet Architecture & Liability Shield

Why the "Master Vendor" and "Wallet" models significantly reduce risk and support for "In the Flow" vs. "Out of the Flow" funds management.

Implementation, Best Practices, and Framework

How to minimize time to market and engineering investment using a decision matrix approach with assessment criteria.

Frequently Asked Questions (FAQ)

Conclusion

Managing payments to influencers and affiliates has become one of the most complex operational challenges facing platforms and marketplaces. Payments are a critical part of workflows for influencer campaigns and affiliate programs. Platforms supporting in this space need to find the right solution to support continued growth while solving for vendor onboarding, compliance, tax, handling potential error states, and importantly minimizing engineering lift and support costs.

In 2026, the top payment platforms to support payouts for platforms include: Lumanu, Wise, Stripe Connect, Tipalti, and PayPal Payouts.

The best payment solutions combine robust compliance features including automated 1099 handling, global pay-in and pay-out capabilities, enterprise-grade security certifications, and transactional fees that scale with usage.

This comprehensive guide examines the leading payment solutions to support influencer & affiliate payouts, and analyzes their features, costs, compliance capabilities, and suitability for different scenarios. Understanding these platform differences is important to make the best decision for managing payments at scale and ensuring regulatory compliance.

Why Choosing the Right Payment Solution for your Influencer & Affiliate Platform Matters

The creator and affiliate payment landscape has evolved. It is easy to send money, but paying individuals at scale introduces friction around:

KYC/KYB: Verifying identities to prevent fraud.

Tax Compliance: Managing the mix of W-9s, W-8BENs, 1099-NECs, and 1099-Ks.

Support Costs: Dealing with "Where is my money?" tickets.

Operational Costs: Managing error states during vendor onboarding, fund transfers, INTL payouts, etc.

The Hidden Costs of Generic Payment Infrastructure

Companies using overly generic or inadequate payment systems often encounter “hidden” expenses that can increase the total cost of ownership

These include:

Engineering Lift: Building role based access controls, funding (invoicing), support for INTL payments, UI for onboarding, and handling various error states.

Support costs: Tracking down payment statuses, updating vendor records and reconciling payouts can lead to hours of time spent across teams

Compliance penalties: IRS fines for improper 1099 reporting can reach $50-$280 per form

Administrative overhead: Manual vendor onboarding and payment processing can result in hidden costs of $700-$1000 per vendor

Foreign exchange losses: Poor FX rates can add 3-7% to international payments

The Strategic Advantage of Modern Payment Solutions

Leading solutions have transformed from simple payment processors into comprehensive solutions that include compliance and support. They offer:

Intuitive vendor onboarding and self service account management

Automated compliance workflows that reduce legal risk

Streamlined implementation that minimize engineering investment

Support for platforms who are “in” or “out” of the money flow

Built in capabilities to easily manage account funding

Integrated reporting that simplifies financial reconciliation

Global payment capabilities that enable international partnerships and payments from various source currencies

Key Capabilities to Evaluate for Payment Solutions

Compliance and Tax Management

Modern businesses require platforms that handle the complex regulatory landscape automatically. Essential compliance features include:

Automated 1099 Generation: Platforms should automatically generate, distribute, and file 1099-NEC forms for U.S. vendors earning over $600 annually. This eliminates manual tracking and reduces filing errors.

International Tax Compliance: For global operations, platforms must navigate varying tax treaties, withholding requirements, and reporting obligations across different jurisdictions.

Lightweight KYB/ KYC: Ensure that you are paying who you think you are paying and that the individual or business is not on any sanctions list (AML/ OFAC screening). Optional checks for adverse media and brand safety.

“Pay-in” Account funding and management

The ability to easily fund account(s) in different currencies and the ability to run reconciliation. Leading platforms support:

Process to fund accounts from platform funds or directly from platform customers

Configurable and compliant invoicing to support AP workflows (customizable based on AP requirements)

Segregated funds in dedicated accounts with running balance and full ledger

Team level budgets and workflows to support companies with different budgets (e.g. influencer, affiliate, social teams)

“Pay-Out” Methods and Global Reach

The ability to pay vendors through their preferred methods significantly impacts satisfaction and retention. Leading platforms support:

Bank transfers in 100+ countries

Local to local payments to reduce fees

Digital wallets including PayPal payouts

Push to card payouts for instant payouts

Security and Certifications

Enterprise-grade security is non-negotiable when handling vendor payments and sensitive business data. Look for platforms with:

SOC 2 Type II certification for operational security controls

ISO 27001 compliance for information security management

Bank-level encryption for data transmission and storage

GDPR compliance for payouts across the EU

Integration Capabilities

Modern payment platforms must integrate seamlessly with existing business systems to maximize efficiency. Key integration features include:

API access for custom workflow automation

Easy vendor onboarding without the need to manage states and errors

Project management tools like custom built platforms, Asana, Airtable, Monday.com

Web hooks to support CRM for unified vendor relationship management

Accounting software integration with QuickBooks, Xero, and NetSuite

Client and Payee Support

Dedicated support teams to handle any potential time sensitive issues that come up. Look for platforms with:

Pre-sales support to help drive adoption of payments and “stickiness” for your platform

Commitment to your platform to address product enhancements and needs

Ongoing dedicated support for your customers and influencer & affiliates

Direct banking relationships to quickly investigate and resolve any banking issues

Detailed Analysis: The Top 6 Payment Solutions for Influencer & Affiliate Platforms

1. Lumanu: The Payments Master Vendor Solution

Lumanu stands out as a solution purpose built to support payments in the creator economy, including influencer marketing and affiliate commissions. Lumanu acts as a single vendor to handle onboarding and compliance for influencers and affiliates verticals, not just a payment processor. By acting as your Master Vendor, Lumanu sits between you and your thousands of creators, absorbing the compliance requirement and liability that usually falls on the platform. Vendors only have to sign up for one Lumanu account which enables them to receive payment from all platforms, agencies and brands using Lumanu.

Best For: Platforms, Marketplaces, Agencies, and Large Enterprise Brands that want to completely offload compliance liability (1099s, W-9s) and minimize engineering lift.

Key Strengths:

Single-vendor-of-record model: eliminates the need for individual vendor agreements and setting up vendors in your systems.

Liability Shield: Lumanu absorbs the liability for W-9 collection, compliance screening, and tax filing so your internal teams do not have to manage these risks.

Zero-friction onboarding: Gives creators a seamless onboarding experience that is purpose-built for individuals and talent management, not complex corporate suppliers.

Low engineering lift: Requires minimal dev resources and code to integrate compared to building custom flows with Stripe or other solutions.

White glove, dedicated support: Provides personalized support for platforms and agency/ enterprise clients and dedicated support to influencers and creators.

Limitations:

Less customization for vendor experience: The onboarding flow is optimized for ease and completions but is less "pixel-perfect" customized when compared to building your own from scratch on Stripe Connect.

Account approval process for SMBs: As a risk-bearing partner, Lumanu may vet SMBs more closely than a generic open API like PayPal.

Funding methods designed for B2B payments: In contrast to Stripe which accepts and processes credit cards, Lumanu supports payments from businesses via ACH and Wire to fund dedicated accounts and send payouts to influencers and affiliates. If you wish to accept credit card payment you would need that additional solution.

Pricing: Transparent and Simple All-In Pricing. Typically a small percentage per payout. No hidden costs for active users, tax modules, different payment rails, FX conversions, or payee KYC/KYB and screenings.

2. PayPal Payouts: The "Consumer" Wallet

PayPal is often chosen because of its global ubiquity, but it operates as a "closed garden" wallet ecosystem for payouts rather than an actual vendor management platform.

Best For: Early-stage startups, one-off marketing campaigns, or micro-payments where collecting vendor information such as bank details adds too much friction.

Key Strengths:

Wide adoption: Most everyone already has a PayPal account, meaning close to zero onboarding friction for recipients.

Global reach: Supports sending funds to 200+ markets instantly without needing bank routing numbers.

Minimal Technical Complexity: The Payouts API is widely considered one of the simplest integrations for developers to implement for basic money movement.

Limitations:

Lack of support: Requests taking days, weeks or longer to get answers and resolutions to.

Operational Continuity Risk: Real risk to operations as PayPal is infamous for freezing business accounts without warning due to "suspicious activity" algorithms, potentially halting your entire payout run.

Reconciliation and ledger complications: Tax and payment data lives inside PayPal, not your systems, making reconciliation difficult. The API was not built to support reporting needs.

Zero support for non-PayPal users: if the influencer/ creator/ affiliate/ talent management company/ etc. does not have a PayPal account or will not accept PayPal for payments, you will need to have an alternative way to make these payments. These exceptions mean you will ALWAYS need a “fallback” solution if going with PayPal.

Potential Hidden Costs for Recipients: When working with creators outside of your country, they effectively earn less because of unfavorable foreign exchange rates when moving funds from their PayPal wallet to their actual bank account.

Pricing: Transaction Fee + Spread. Domestic payouts cost roughly 2% (capped), but international payments often include a 3-7% currency conversion spread buried in the exchange rate.

3. Stripe Connect: The Developer's Toolkit

Stripe Connect is the industry standard infrastructure for building complex marketplaces, offering powerful APIs but requiring significant internal resources to build and maintain.

Best For: Engineering-led teams building highly custom, complex payment flows (e.g., splitting payments 3 ways) who want total control over the UI.

Key Strengths:

Infinite Customizability: You can build virtually any payment flow, UI, or funds-splitting logic imaginable if you have the engineering resources to support a custom build.

Unified Card Processing and Payouts: The platform is excellent for marketplaces that need to both accept credit card payments from users and pay creators within the same financial ecosystem.

World-Class Documentation: Developers benefit from industry-leading API documentation and tooling, which can speed up the initial "Hello World" integration.

Limitations:

Complex Fee Structures: Stripe employs a "nickel and dime" approach where you pay separately for active accounts, per-payout fees, 1099 filing fees, identity verification, and instant payout surcharges. Not only are these fees not always transparent, they can also vary over time leading to unpredictable costs for certain markets and compliance requirements.

Retained Vendor Liability: Despite using their software, your company generally remains the Merchant of Record, meaning you retain the full legal liability for sanctions screening and tax compliance failures.

High Ongoing Maintenance: A custom Stripe integration requires significant ongoing engineering maintenance to handle edge cases, banking error states, and evolving compliance rules.

Global coverage/ International Payments: Strip has some unexpected country specific limitations (vendors unable to create Stripe accounts) so make sure that the specific payout countries you require are supported.

Pricing: Complex Variable Pricing. Monthly fees per active user + per-transaction fees + 1099 filing fees + FX per payment and % based fees.

4. Tipalti: The AP Automation Giant

Tipalti is a heavyweight Accounts Payable solution designed for traditional corporate finance teams processing thousands of invoices. In recent years, Tipalti’s “Mass Pay” capability does support bulk payouts using CSV files and API calls as an effort to win more platforms and marketplaces.

Best For: Mature Enterprise finance departments that treat creators like traditional suppliers and prioritize ERP integration (NetSuite/Oracle) over creator experience.

Key Strengths:

Deep ERP Integration: The platform offers robust, bi-directional synchronization with enterprise accounting systems like NetSuite, Intacct, and QuickBooks for automated reconciliation.

Advanced Fraud Protection: Finance teams benefit from "Payee Monitoring" features that help detect duplicate invoices or fraudulent vendors before payments are released.

Mass Global Batching: The infrastructure is capable of handling tens of thousands of line items in a single batch file, making it suitable for massive, traditional AP runs.

Limitations:

Clunky Vendor Portal: The onboarding interface is formal, complex, and not optimized for mobile-first creators, which often leads to confusion and high drop-off rates during enrollment.

Heavy Implementation: The integration process can take weeks or months to finalize, making it an "overkill" solution for agile software platforms that need to move fast.

High Cost of Entry: Tipalti is generally the most expensive option in the market, with high platform minimums that often price out growth-stage companies.

Pricing: Enterprise Custom. High monthly platform fee (often $1k+) plus per-transaction costs.

5. Wise: The International Specialist

Wise (formerly TransferWise) is a "money mover" known for transparency, but requires significant engineering resources to build and maintain vendor onboarding, handling error states and failed payments and ledger management.

Best For: Smaller agencies or platforms making low-volume international transfers where getting the absolute best exchange rate is the only priority.

Key Strengths:

Transparent Exchange Rates for Payors: Wise uses the mid-market exchange rate and clearly displays their fee, often resulting in costs that are 3-5% cheaper than traditional banks.

Speed of Transfer: The network is optimized for velocity, with many international transfers arriving instantly or within hours rather than days.

Ease of Setup: It is incredibly easy to set up a business account and start sending money immediately without a complex sales or integration process.

Limitations:

Unclear Exchange Rates for Creators: When you set up a recipient to receive a payment in a different currency the funds will just hit their bank account. This can lead to confusion and support costs

Absence of Compliance Layer: Wise is strictly a money movement tool; it does not collect W-9s, file 1099s, or validate vendor identities for tax purposes.

Manual Data Management and Reconciliation: Using Wise at scale requires significant manual work (or a custom API build) to track exactly who has been paid for year-end tax reporting and reconciliation. Because rates float and there may be fixed fees that can vary, it is very difficult to reconcile what you expect to send versus what you actually pay.

Unpredictable Account Limits: Business accounts can be subject to volume limits or freezes if sudden high-volume payout activity occurs, as the system is not designed for mass-payout orchestration.

Pricing: Pay-As-You-Go. Fixed fee (e.g., $0.50) + variable fee (e.g., 0.43%) per transfer.

Operational Comparison: Capabilities & Engineering Lift

Instead of looking at just transaction fees—which can be misleading—founders should look at the Total Cost of Operations.

Feature / Capability | Lumanu | PayPal Payouts | Stripe Connect | Tipalti | Wise |

Vendor onboarding and compliance | Yes. Fully handles out of the box and takes on all compliance | No | Yes. Gives you the building blocks to setup onboarding and compliance. Platform must manage all states. | Yes. Provides rigid onboarding flow. Your platform must manage support. | No |

Tax Filing | Lumanu files 1099 | PayPal files 1099-K | Platform files (via Stripe Tax) | Platform files | Platform files |

Liability Shield | High (Lumanu is legal vendor) | Medium (PayPal owns K, you own relationship) | Low | Low | Low |

Creator Experience | Seamless and unified. Purpose built for creators | PayPal experience | Mixed (must have Stripe account) | Enterprise grade but difficult | Standard |

Engineering Lift | Low | Low (Simple API) | High (Custom Build) | Medium/High | Medium |

Pricing Model | Simple, All-in transaction based pricing | Tx Fee + FX + Spread | Complex (Per cap + %) | High SaaS + Tx | SaaS + Tx + FX |

Hidden Costs to Consider

Compliance Management: Manual 1099 preparation and filing can cost $25-$50 per form when outsourced to accounting firms. Platforms with automated compliance can save thousands annually for businesses with large vendor networks.

Foreign Exchange Margins: Traditional banks and some payment platforms add 2-5% margins to currency conversions. Over time, these margins can exceed transaction fees for international payments.

Administrative Overhead: Manual vendor onboarding, payment processing, and record-keeping can consume 2-5 hours per vendor monthly. Automated platforms reduce this to minutes, representing significant labor cost savings.

Integration and Setup Costs: While some platforms offer free setup, enterprise implementations may require custom integration work costing $10,000-$50,000 for complex workflows.

Exception Handling: When payments fail, a certain country is not available to send funds to, or vendors enter incorrect banking details, the true time and cost to resolve the issue can take hours of time and context switching across the team. Manual error state management, including handling failed webhooks, rejected ACH/wire transfers, and banking delays, consumes valuable engineering time and can lead to frustrated customers and influencers.

Support Costs: High volumes of "Where is my money?" tickets due to payment delays, FX confusion, or clunky vendor portals create a heavy burden. Dealing with payment status inquiries, updating vendor records, and manual reconciliation can consume hours of time across customer support and finance teams, significantly increasing your overall Total Cost of Operations. Platforms with dedicated vendor support and seamless user experiences can reduce these support tickets drastically.

Fraud risk: There has been a spike in hacked email accounts of influencers and affiliates with bad actors attempting to divert funds paid by platforms to different bank accounts. Platforms with strong ID verification onboarding flows, 2FA and other security measure (e.g. IP monitoring) can help protect against siphoned funds.

Why Lumanu is Different

1) The "Master Vendor" Advantage

Most platforms (Stripe, Wise, Tipalti) function as Software & Rails. You are still the legal merchant for every creator you pay. This means:

Liability: If a creator is on a sanctions list (OFAC), you are liable.

Support: When a bank transfer fails, your team has to debug it.

Tax: You are responsible for the accuracy of every W-9.

Lumanu acts as your Single Vendor. When you pay through Lumanu, you pay Lumanu. We then distribute funds to the creators.

For Finance: You deal with 1 vendor instead of 10,000.

For Tech: You integrate one endpoint. We handle the banking error states, the KYC failures, and the tax data updates.

For Creators: They get a single, clean 1099 at the end of the year.

2) The "Wallet Advantage"

One underestimated challenge in building a payout capability is Ledgering. If you use a traditional processor or AP solution (Stripe Connect, Wise, Tipalti, PayPal) your platform is responsible for tracking every penny. You must build a system that manages: "Customer A has $50 pending, $10 available, and $5 in transit."

The Risk: If your internal ledger falls out of sync with the actual bank balance (due to a failed web hook, a refund, or a currency fluctuation), you are liable for the difference.

The Lumanu Solution: Lumanu provides a Creator Wallet architecture. We act as the ledger. You simply instruct us to "Pay Creator A $500," and the funds move into their Lumanu Wallet.

Flexible Funds Flow: In or Out? Because Lumanu uses this Wallet architecture, we support flexible workflows that other providers cannot:

In the Flow of Funds: You fund your Platform Lumanu Master Account Wallet as needed with bank transfers and compliant invoicing (often aligning with your customer funds). You then API-trigger payouts to thousands of Creator Wallets instantly. Lumanu supports custom fields to easily track payouts by customer ID and campaign.

Out of the Flow of Funds: You can have your brands or third parties pay Lumanu directly, each to a unique and segregated bank account. Your platform supports creating funding requests for your customers to “top off” funds. You never touch the money, removing you from the flow of funds entirely and significantly reducing your regulatory burden. Your platform manages payout workflow across your customers via dedicated supporting Lumanu accounts.

Why this matters: With Stripe, "holding" funds requires complex escrow licenses or "FBO" (For Benefit Of) accounts. With Lumanu, the money sits in the User's Wallet, not your platform's balance sheet.

Implementation Best Practices: Minimizing Time to Market and Implementation Engineering resources

Successful influencer payment platform implementation requires planning and attention to operational details that can significantly reduce time to market and potential decisions that lead to ongoing support costs.

Integration Planning

System Mapping: Document existing systems that need to integrate with the payment platform along with data flows. Include your platform along with any external systems like accounting software or project management tools.

Joint API Integration Plan: Work with your chosen partner to develop a shared integration plan along with open communication channels (e.g. Slack). Define clear deliverables and phases to move from design to sandbox to production.

Workflow Automation and Complexity Reduction: Identify opportunities to automate current manual processes through platform features and API integrations. Where possible reduce steps and complications from your existing process.

Onboarding Strategy

Phased Rollout: Implement the platform with a test campaign or customer first to identify and resolve issues before full deployment.

Training Programs: Provide training for internal teams (and potentially creators depending on onboarding flow) to ensure smooth adoption and minimize support requests.

Communication Planning: Develop clear communication about the transition, including timelines, benefits, and support resources.

Performance Monitoring

Key Metrics Tracking: Monitor payment processing times and late payments, vendor satisfaction scores, compliance accuracy, and cost per transaction.

Regular Reviews: Conduct quarterly reviews of platform performance against business objectives and vendor feedback.

Optimization Opportunities: Continuously identify ways to improve workflows and reduce costs through platform feature utilization.

Making the Right Choice: Platform Selection Framework

Selecting the optimal freelance payment platform requires a systematic evaluation of your specific business needs, constraints, and growth objectives.

Assessment Criteria

Payment Volume and Frequency: High-volume operations may benefit from platforms offering volume discounts.

Geographic Distribution: Businesses with concentrated regional vendor bases may prioritize platforms with strong local capabilities over global reach. Ensure that each region can be supported via siloed workspaces.

Integration Needs: Companies with sophisticated technology stacks require platforms with comprehensive API capabilities and pre-built integrations.

Growth Trajectory: Consider platforms that can scale with your business and add features as your needs evolve. Ability to influence the roadmap can go a long way to future proofing your business.

Client type: If your clients who pay you are enterprises, agencies, brands, consumers, etc impact who you should pick. For example if your clients are enterprise brands and agencies who need more robust controls, you will have to build that yourself because some payment tools like Stripe and PayPal and Tipalti do not support robust controls and separation of funds.

Decision Matrix Approach

Create a weighted scoring system that reflects your priorities:

Cost Structure (Weight: 20%): Total cost of ownership including fees, implementation, and administrative savings

Compliance Capabilities (Weight: 20%): Automation level, accuracy, and coverage of regulatory requirements

User Experience (Weight: 20%): Ease of use for both internal teams and vendors

Integration Capabilities (Weight: 10%): These are table stakes but API quality, pre-built integrations, and customization options should meet your requirements

Support and Reliability (Weight: 30%): Customer service quality, uptime, and issue resolution speed. Ensuring your partner can handle front line support when dealing with a large volume of influencer payouts is crucial, as is ensuring your payment infrastructure will b e available when your customers need it.

Frequently Asked Questions

What is the best way for platforms to manage influencer payouts?

The best method depends on your business size and needs, but leading platforms like Lumanu, Stripe Connect and Tipaliti offer secure, compliant solutions with global reach and varying degrees of tax compliance support.

Which payment solution is best for platforms paying international influencers?

Wise and PayPal excel at international payments with competitive exchange rates and broad global coverage, while Lumanu offers superior compliance automation for enterprise clients with international vendor networks.

Does a "Wallet" infrastructure help me if I want to avoid holding funds as a platform?

Yes, it is the best solution for that. Many marketplaces want to trigger payments without actually taking possession of the funds. Because Lumanu assigns a real, functional wallet to every customer and creator, you can route payments from your customers directly to creators. The funds land in your customer’s wallet which is a dedicated bank account, not a sub-account on your books. This allows you to orchestrate the transaction without being the custodian of the cash.

How do influencer payment solutions handle tax and compliance for platforms?

Most modern platforms help collect and validate information and assist with automatic 1099 generation for U.S. vendors. They also may handle international tax withholding requirements, and maintain documentation for compliance audits. If you work with a solution like Lumanu who is a master vendor, the solution will take all on all tax compliance so that you do not have to.

Are there payment solutions with low fees for influencers?

Wise offers the lowest fees for international transfers using mid-market exchange rates, while enterprise platforms like Lumanu do not charge fees to influencers and provide custom pricing that can be more cost-effective for high-volume operations.

What is the safest way to pay influencers via a payment solution?

Use platforms with SOC 2 Type II certification, bank-level encryption, and comprehensive insurance coverage. Lumanu, and other enterprise-grade platforms offer the highest security standards for business payments.

Conclusion: Choosing Your Ideal Influencer Payment Platform

The payment platform you choose to manage your influencer payouts will significantly impact your operational efficiency and ultimately your customer relationships. While cost considerations are very important, the total value equation must include compliance automation, security features, support, integration capabilities, and long-term scalability.

For platforms managing complex vendor networks, particularly in the creator economy and influencer marketing space, platforms like Lumanu offer the compliance, automation, and integration capabilities needed to scale operations efficiently while minimizing risk.

Partnering with a robust and purpose built payment platform pays dividends through reduced administrative overhead, improved compliance accuracy, enhanced influencer satisfaction, and the operational flexibility to focus on roadmap opportunities to win more customers without payment infrastructure constraints.

Ready to transform your payment operations with enterprise-grade compliance and automation? Request a Demo to see how Lumanu can streamline your influencer payment operations management while ensuring comprehensive compliance.

Who's This Guide For?

This guide is specifically written for the Founder, CTO, or Head of Finance of:

Influencer Marketing Platforms (IMPs) and Marketplaces

Affiliate Network and Partner Program Platforms

Vertical SaaS Solutions that facilitate payouts to creators, freelancers, and large vendor networks.

If you are tasked with making a critical technology decision on payment infrastructure, minimizing engineering lift, reducing compliance risk, and lowering your total cost of operations for global payouts, this is your essential reading.

Table of Contents

The Critical Challenge of Influencer Payments

Why payments are a complex operational challenge and an introduction to the top influencer payment solutions for 2026.

The True Cost of Payment Infrastructure

The Strategic Advantage of Modern Solutions with an analysis into the hidden costs of general payout solutions (Engineering Lift, Compliance, FX).

Essential Capabilities: What to Evaluate

The core considerations: Compliance, Tax Management & Liability (1099s, KYB/KYC), Funding, Pay-Out Methods, Global Reach, Security, Certifications (SOC 2), and Integration Needs.

In-Depth Platform Analysis: The Top 5 Solutions

Lumanu: The Payments Master Vendor Solution (Master Vendor Model).

Stripe Connect: The Developer's Toolkit (Customizability vs. Liability).

Tipalti: The AP Automation Giant (Enterprise Finance Focus).

PayPal Payouts: The "Consumer" Wallet (Global Wallet Reach).

Wise: The International Specialist (Best FX Rates).

Operational Comparison: Total Cost & Engineering Lift

Feature comparison table and deeper analysis of hidden costs.

The Lumanu Advantage: Wallet Architecture & Liability Shield

Why the "Master Vendor" and "Wallet" models significantly reduce risk and support for "In the Flow" vs. "Out of the Flow" funds management.

Implementation, Best Practices, and Framework

How to minimize time to market and engineering investment using a decision matrix approach with assessment criteria.

Frequently Asked Questions (FAQ)

Conclusion

Managing payments to influencers and affiliates has become one of the most complex operational challenges facing platforms and marketplaces. Payments are a critical part of workflows for influencer campaigns and affiliate programs. Platforms supporting in this space need to find the right solution to support continued growth while solving for vendor onboarding, compliance, tax, handling potential error states, and importantly minimizing engineering lift and support costs.

In 2026, the top payment platforms to support payouts for platforms include: Lumanu, Wise, Stripe Connect, Tipalti, and PayPal Payouts.

The best payment solutions combine robust compliance features including automated 1099 handling, global pay-in and pay-out capabilities, enterprise-grade security certifications, and transactional fees that scale with usage.

This comprehensive guide examines the leading payment solutions to support influencer & affiliate payouts, and analyzes their features, costs, compliance capabilities, and suitability for different scenarios. Understanding these platform differences is important to make the best decision for managing payments at scale and ensuring regulatory compliance.

Why Choosing the Right Payment Solution for your Influencer & Affiliate Platform Matters

The creator and affiliate payment landscape has evolved. It is easy to send money, but paying individuals at scale introduces friction around:

KYC/KYB: Verifying identities to prevent fraud.

Tax Compliance: Managing the mix of W-9s, W-8BENs, 1099-NECs, and 1099-Ks.

Support Costs: Dealing with "Where is my money?" tickets.

Operational Costs: Managing error states during vendor onboarding, fund transfers, INTL payouts, etc.

The Hidden Costs of Generic Payment Infrastructure

Companies using overly generic or inadequate payment systems often encounter “hidden” expenses that can increase the total cost of ownership

These include:

Engineering Lift: Building role based access controls, funding (invoicing), support for INTL payments, UI for onboarding, and handling various error states.

Support costs: Tracking down payment statuses, updating vendor records and reconciling payouts can lead to hours of time spent across teams

Compliance penalties: IRS fines for improper 1099 reporting can reach $50-$280 per form

Administrative overhead: Manual vendor onboarding and payment processing can result in hidden costs of $700-$1000 per vendor

Foreign exchange losses: Poor FX rates can add 3-7% to international payments

The Strategic Advantage of Modern Payment Solutions

Leading solutions have transformed from simple payment processors into comprehensive solutions that include compliance and support. They offer:

Intuitive vendor onboarding and self service account management

Automated compliance workflows that reduce legal risk

Streamlined implementation that minimize engineering investment

Support for platforms who are “in” or “out” of the money flow

Built in capabilities to easily manage account funding

Integrated reporting that simplifies financial reconciliation

Global payment capabilities that enable international partnerships and payments from various source currencies

Key Capabilities to Evaluate for Payment Solutions

Compliance and Tax Management

Modern businesses require platforms that handle the complex regulatory landscape automatically. Essential compliance features include:

Automated 1099 Generation: Platforms should automatically generate, distribute, and file 1099-NEC forms for U.S. vendors earning over $600 annually. This eliminates manual tracking and reduces filing errors.

International Tax Compliance: For global operations, platforms must navigate varying tax treaties, withholding requirements, and reporting obligations across different jurisdictions.

Lightweight KYB/ KYC: Ensure that you are paying who you think you are paying and that the individual or business is not on any sanctions list (AML/ OFAC screening). Optional checks for adverse media and brand safety.

“Pay-in” Account funding and management

The ability to easily fund account(s) in different currencies and the ability to run reconciliation. Leading platforms support:

Process to fund accounts from platform funds or directly from platform customers

Configurable and compliant invoicing to support AP workflows (customizable based on AP requirements)

Segregated funds in dedicated accounts with running balance and full ledger

Team level budgets and workflows to support companies with different budgets (e.g. influencer, affiliate, social teams)

“Pay-Out” Methods and Global Reach

The ability to pay vendors through their preferred methods significantly impacts satisfaction and retention. Leading platforms support:

Bank transfers in 100+ countries

Local to local payments to reduce fees

Digital wallets including PayPal payouts

Push to card payouts for instant payouts

Security and Certifications

Enterprise-grade security is non-negotiable when handling vendor payments and sensitive business data. Look for platforms with:

SOC 2 Type II certification for operational security controls

ISO 27001 compliance for information security management

Bank-level encryption for data transmission and storage

GDPR compliance for payouts across the EU

Integration Capabilities

Modern payment platforms must integrate seamlessly with existing business systems to maximize efficiency. Key integration features include:

API access for custom workflow automation

Easy vendor onboarding without the need to manage states and errors

Project management tools like custom built platforms, Asana, Airtable, Monday.com

Web hooks to support CRM for unified vendor relationship management

Accounting software integration with QuickBooks, Xero, and NetSuite

Client and Payee Support

Dedicated support teams to handle any potential time sensitive issues that come up. Look for platforms with:

Pre-sales support to help drive adoption of payments and “stickiness” for your platform

Commitment to your platform to address product enhancements and needs

Ongoing dedicated support for your customers and influencer & affiliates

Direct banking relationships to quickly investigate and resolve any banking issues

Detailed Analysis: The Top 6 Payment Solutions for Influencer & Affiliate Platforms

1. Lumanu: The Payments Master Vendor Solution

Lumanu stands out as a solution purpose built to support payments in the creator economy, including influencer marketing and affiliate commissions. Lumanu acts as a single vendor to handle onboarding and compliance for influencers and affiliates verticals, not just a payment processor. By acting as your Master Vendor, Lumanu sits between you and your thousands of creators, absorbing the compliance requirement and liability that usually falls on the platform. Vendors only have to sign up for one Lumanu account which enables them to receive payment from all platforms, agencies and brands using Lumanu.

Best For: Platforms, Marketplaces, Agencies, and Large Enterprise Brands that want to completely offload compliance liability (1099s, W-9s) and minimize engineering lift.

Key Strengths:

Single-vendor-of-record model: eliminates the need for individual vendor agreements and setting up vendors in your systems.

Liability Shield: Lumanu absorbs the liability for W-9 collection, compliance screening, and tax filing so your internal teams do not have to manage these risks.

Zero-friction onboarding: Gives creators a seamless onboarding experience that is purpose-built for individuals and talent management, not complex corporate suppliers.

Low engineering lift: Requires minimal dev resources and code to integrate compared to building custom flows with Stripe or other solutions.

White glove, dedicated support: Provides personalized support for platforms and agency/ enterprise clients and dedicated support to influencers and creators.

Limitations:

Less customization for vendor experience: The onboarding flow is optimized for ease and completions but is less "pixel-perfect" customized when compared to building your own from scratch on Stripe Connect.

Account approval process for SMBs: As a risk-bearing partner, Lumanu may vet SMBs more closely than a generic open API like PayPal.

Funding methods designed for B2B payments: In contrast to Stripe which accepts and processes credit cards, Lumanu supports payments from businesses via ACH and Wire to fund dedicated accounts and send payouts to influencers and affiliates. If you wish to accept credit card payment you would need that additional solution.

Pricing: Transparent and Simple All-In Pricing. Typically a small percentage per payout. No hidden costs for active users, tax modules, different payment rails, FX conversions, or payee KYC/KYB and screenings.

2. PayPal Payouts: The "Consumer" Wallet

PayPal is often chosen because of its global ubiquity, but it operates as a "closed garden" wallet ecosystem for payouts rather than an actual vendor management platform.

Best For: Early-stage startups, one-off marketing campaigns, or micro-payments where collecting vendor information such as bank details adds too much friction.

Key Strengths:

Wide adoption: Most everyone already has a PayPal account, meaning close to zero onboarding friction for recipients.

Global reach: Supports sending funds to 200+ markets instantly without needing bank routing numbers.

Minimal Technical Complexity: The Payouts API is widely considered one of the simplest integrations for developers to implement for basic money movement.

Limitations:

Lack of support: Requests taking days, weeks or longer to get answers and resolutions to.

Operational Continuity Risk: Real risk to operations as PayPal is infamous for freezing business accounts without warning due to "suspicious activity" algorithms, potentially halting your entire payout run.

Reconciliation and ledger complications: Tax and payment data lives inside PayPal, not your systems, making reconciliation difficult. The API was not built to support reporting needs.

Zero support for non-PayPal users: if the influencer/ creator/ affiliate/ talent management company/ etc. does not have a PayPal account or will not accept PayPal for payments, you will need to have an alternative way to make these payments. These exceptions mean you will ALWAYS need a “fallback” solution if going with PayPal.

Potential Hidden Costs for Recipients: When working with creators outside of your country, they effectively earn less because of unfavorable foreign exchange rates when moving funds from their PayPal wallet to their actual bank account.

Pricing: Transaction Fee + Spread. Domestic payouts cost roughly 2% (capped), but international payments often include a 3-7% currency conversion spread buried in the exchange rate.

3. Stripe Connect: The Developer's Toolkit

Stripe Connect is the industry standard infrastructure for building complex marketplaces, offering powerful APIs but requiring significant internal resources to build and maintain.