Automated tax and regulatory compliance.

Stop manual tax work and compliance risk from slowing you down. Lumanu acts as your master vendor and handles W-9/ W-8 collection, 1099 filings.

Why Lumanu?

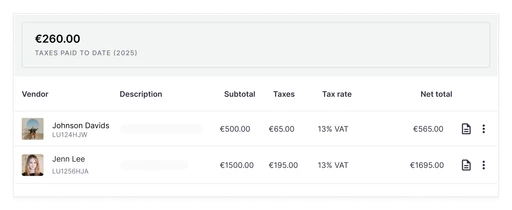

Fully managed tax filings & regulatory tasks

Eliminate Risk with Automated, End-to-End Tax Compliance

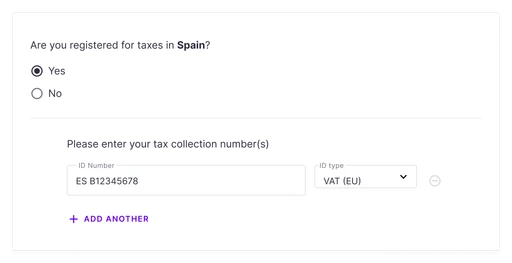

Vendor Tax Identification & Validation

Ensure accuracy from the start. Lumanu automates real-time collection and validation of vendor W8/W9 and global tax IDs (e.g. VAT/GST).

End-to-End 1099 Reporting

Eliminate year-end chaos. Lumanu takes on the entire IRS-1099 reporting process, from data aggregation to accurate, timely electronic filing with the IRS.

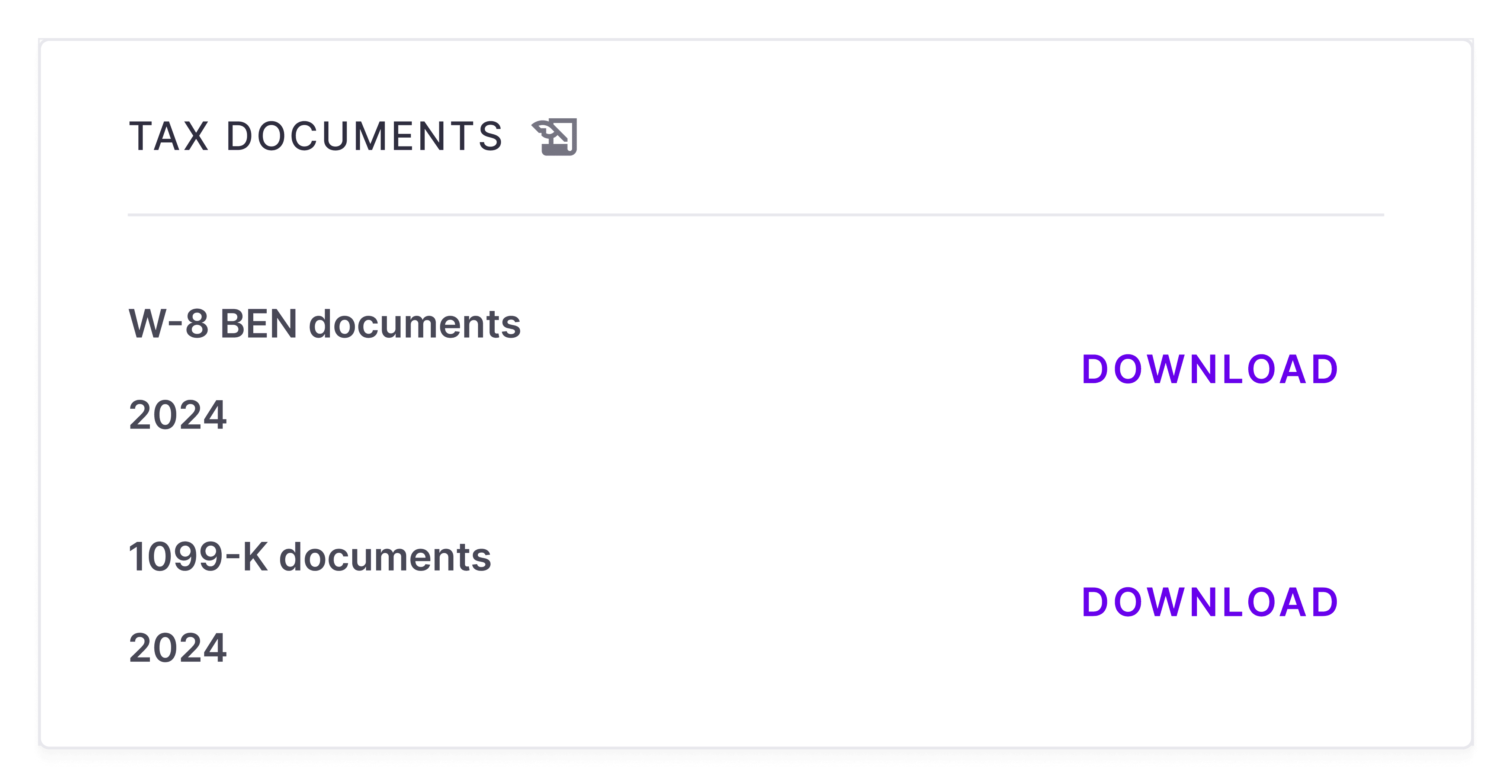

Centralized Audit-Ready Documentation

Confidently face audits with accessible, immutable records. Lumanu provides a centralized repository of all collected tax forms, generated invoices, and filings.