By

Kam Thandi

Oct 18, 2025

The risks of accepting payment via PayPal’s “Friends and Family” payout option

Updated: December 2025 to include newly published PayPal policies which went into effect on July 16, 2025

As a creator, when you accept payment from your brand partners in exchange for your content and services you are considered a "seller" by PayPal's acceptable use policy. As sellers, creators should never accept payment from their brand partners via the "friends and family" option through PayPal. Accepting payment through the "friends and family" option puts the creator PayPal account and funds at risk of being frozen.

The risk also applies to the payor. Brands and agencies, if you are paying creators using PayPal's 'Friends & Family' method for business expenses you are putting your account along with creator partners at risk. You may also be introducing unforeseen compliance headaches and complicating financial reconciliations or audits. This article explores why this common practice is problematic for everyone involved and what safer, more professional alternatives exist.

What is the “friends and family” payout option vs. the “goods and services” payout option on PayPal?

When your brand partner is electing to send your payment via PayPal, they will have two types of transactions to choose from. Per PayPal’s help center they define the difference between sending money “friends and family” or as “goods and services” as the following:

Sending to a friend and family - used when sending money or a gift card to a friend or family member. Before you complete a payment, you can opt to pay the fee, or pass it onto the recipient to be covered by PayPal Purchase Protection.

Paying for goods or services - used when buying an item or service from someone. When you make a purchase, the seller pays a small fee to receive your money. Your payment is covered by our protection policy automatically.

What are the PayPal Fees associated with “friends and family” vs. “goods or services?”

The friends and family payout method is intended for occasions like sending cash gifts or paying back friends/family members for casual personal purposes. (splitting dinners, splitting hotel costs, etc.)

When paying on credit/debit: 2.9% fee

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money.

When paying from a US bank account: 0% fee

If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Goods and Services “Seller fees”

When sending money for “goods and services”, the “seller” will incur a fee of 2.9% + 30 cents per transaction. The “seller” is the one receiving the money from the “buyer."

Are content creators considered “sellers” on PayPal?

Short answer: Yes.

As an influencer, content creator, or freelancer, when you charge a brand for your services you are considered a “seller” providing a “good or service” to the brand who is considered a “buyer.” Accepting payments when collaborating with brands is considered a commercial transaction.

Why do brand partners request to send payment to creators via the PayPal “friends and family” option?:

The reason why a brand partner may offer to pay a creator via the “friends and family” option instead of the “goods and services” option is simple- it’s free (if the recipient is in the US and the brand is paying from a bank account.)

Per PayPal's fee policy, if a brand were to select to pay a creator via the compliant "goods and services" option, then the creator would be subject to pay the 2.9% +30 cents per transaction seller fee. Some brands may offer to send the money non-compliantly via the "friends and family" to avoid having to cover the fees on behalf of the creator or as an option for the creator to avoid incurring the fees themselves.

What are the risks and penalties of accepting money via the “friends and family” PayPal option?

As Sellers, Creators are held responsible for violating PayPal’s policy:

Using PayPal friends and family for business purchases is explicitly against their User Agreement (under the category of “Restricted Activities -section Af.)

When a brand offers to send the money non-compliantly to pay a creator for their goods and services via the “friends and family” payout option, the brand is not held accountable for the legal liability or penalties for violating PayPal’s terms of service. As the “seller”, the creator is responsible for accepting payment compliantly and would be the party penalized.

Key Details from PayPal's Upcoming User Agreement Update (Effective July 16, 2025):

PayPal has announced updates to its User Agreement, effective July 16, 2025. For creators, the most significant change is a clearer line drawn between personal and business account usage, along with more explicit information on what happens if you're using your personal account for business transactions.

One key takeaway from the updated terms is that if your personal account activity looks like a business, PayPal might force a switch to a business account or close your personal account which can result in frozen funds.

The new user agreement states:

"If the activity associated with your personal account primarily involves business or commercial activity, PayPal may close your account unless you agree to cease the business or commercial activity or convert your personal account to a business account.”

This means continuing to accept payments for your creative work via PayPal 'Friends & Family' is becoming even riskier. These payments are intended for personal gifts and reimbursements, not for business income.

Risk of Banned/Locked Accounts:

The PayPal Enforcement Division team may lock or ban your account if you are suspected of accepting money for goods and services as a seller via the “friends and family” option. PayPal locks accounts that are suspected of violating the terms of services for restricted activities in order to complete an investigation. Even if you are not banned after the investigation is complete, you will be locked out of your account and unable to access your funds for the length of the investigation until PayPal can close the case which can take several months-years to reach a verdict.

Daily limits:

PayPal limits the amount of money a seller can receive to $60,000 per day. Each transaction cannot exceed $10,000. For some creators, being sent money from brand partners that exceed this amount can lead to getting their account locked for investigation.

Lack of Protection and limited ability to resolve disputes:

When accepting money via the friends and family method, PayPal offers does not offer protection or dispute assistance if something were to go wrong with the payment. When sending/accepting money via the “goods and services” option, all transactions are backed by PayPal’s protection program.

To put it simply, according to the article by Moneysavingexpert.com, “A PayPal spokesperson said: "PayPal Buyer Protection does not cover money transfers between friends or family. If someone selling you goods or a service asks you to send a friends and family payment, you should refuse.”

Why Brands and Agencies Should Rethink PayPal F&F for Creator Payments

For brands and agencies dedicated to building strong, professional relationships with creators and maintaining control and visibility over financial operations, how you send payments is an important detail. Relying on PayPal's 'Friends & Family' for business services might seem like an easy workaround, but it goes against PayPal's T&Cs and if you're paying personal accounts from a business account these transactions are likely to be flagged.

Consider the implications:

Frozen Funds: Payments are sent but the creator's account is frozen for weeks and they are unable to actually receive their payment.

Scale: Can your team efficiently manage payments, tax forms, and reporting for dozens or hundreds of creators using a system not purpose built for it?

Compliance: Are you confident that your payment practices meet tax compliance regulations when using informal channels?

Creator Experience: Does your payment process reflect the value you place on your creative collaborators?

Shifting to a payment platform designed for B2B creator payouts not only mitigates these risks but also streamlines your workflow, enhances compliance, and positions your organization as a preferred partner in the creator economy

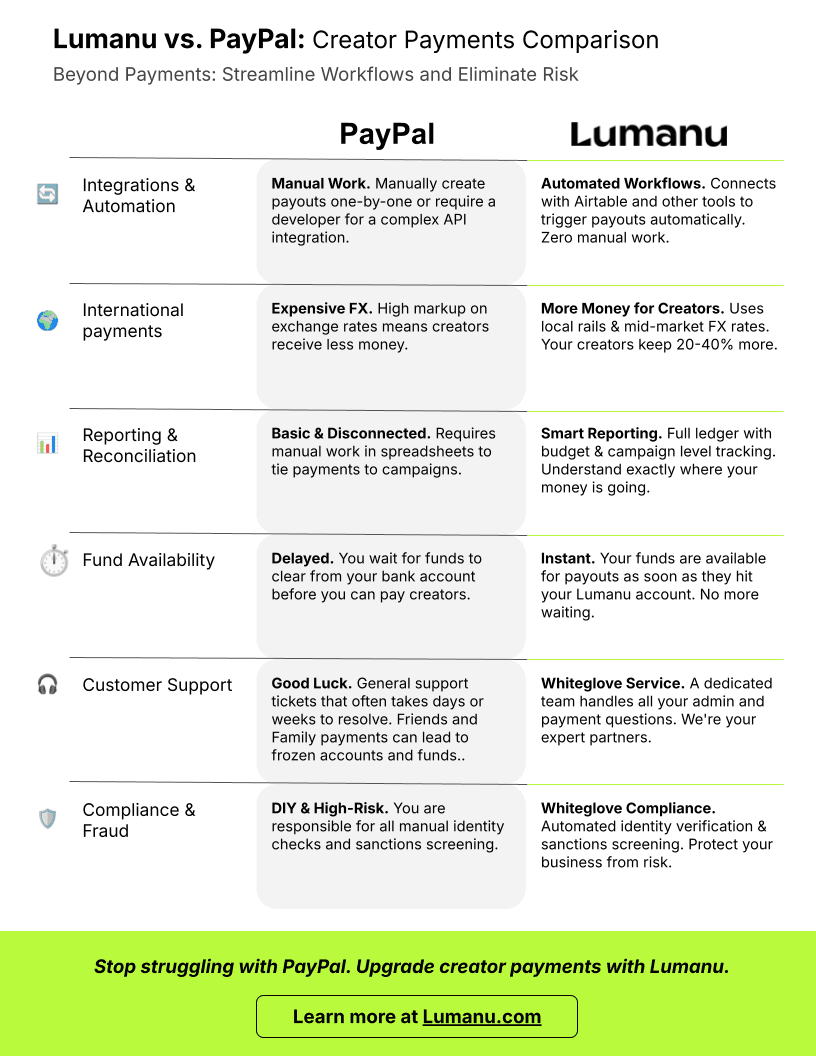

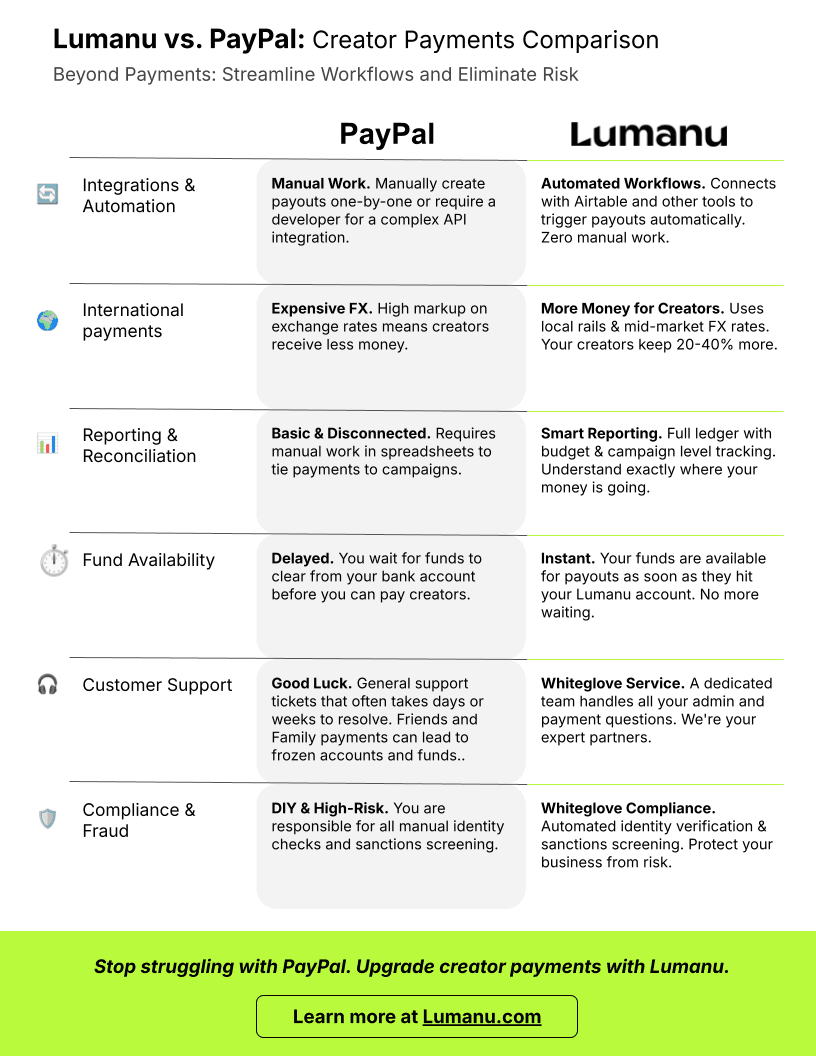

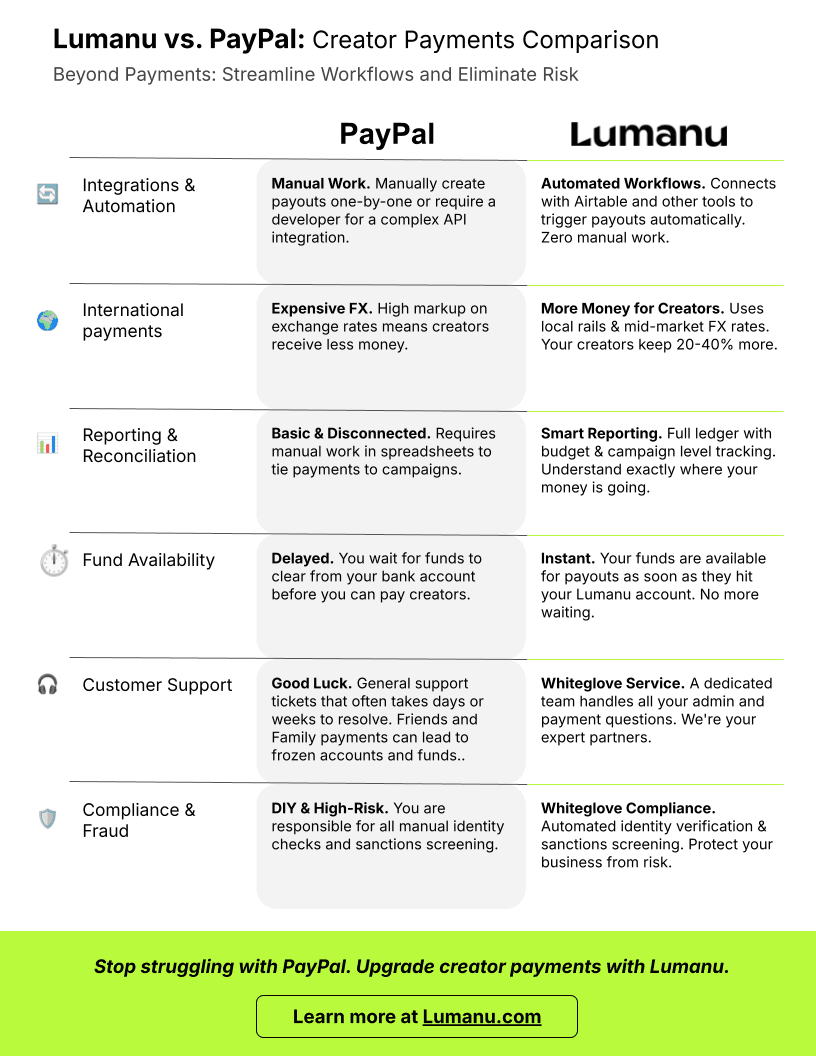

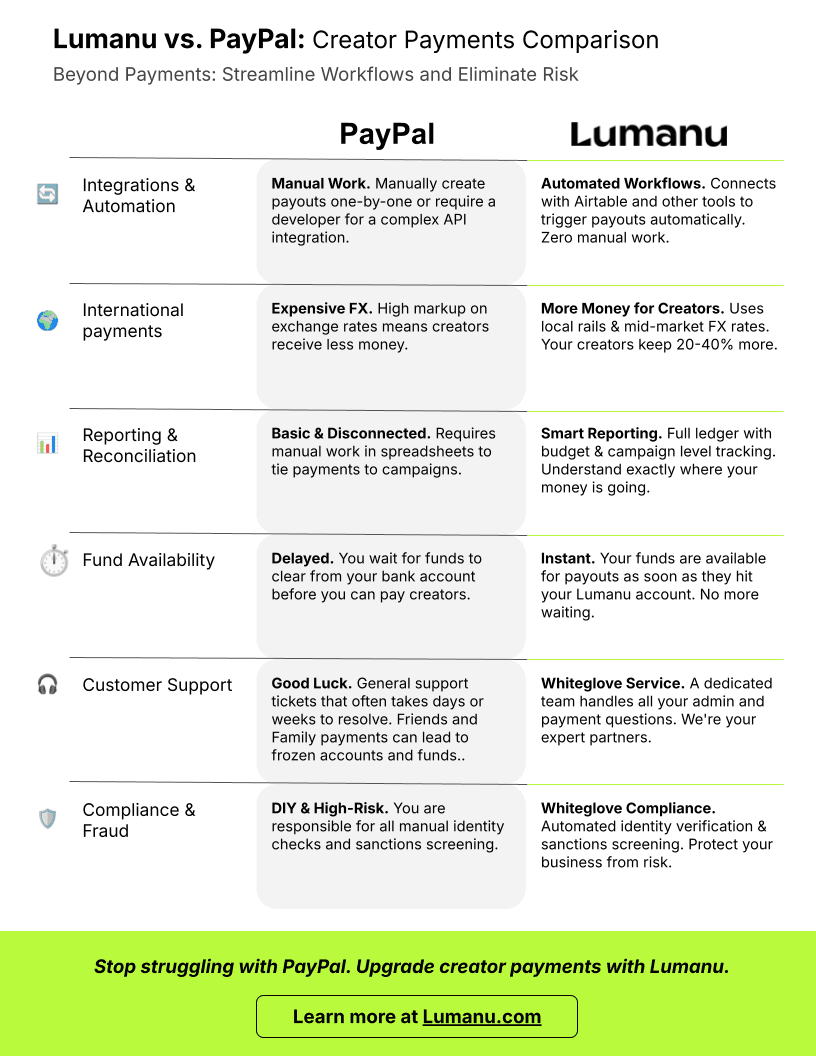

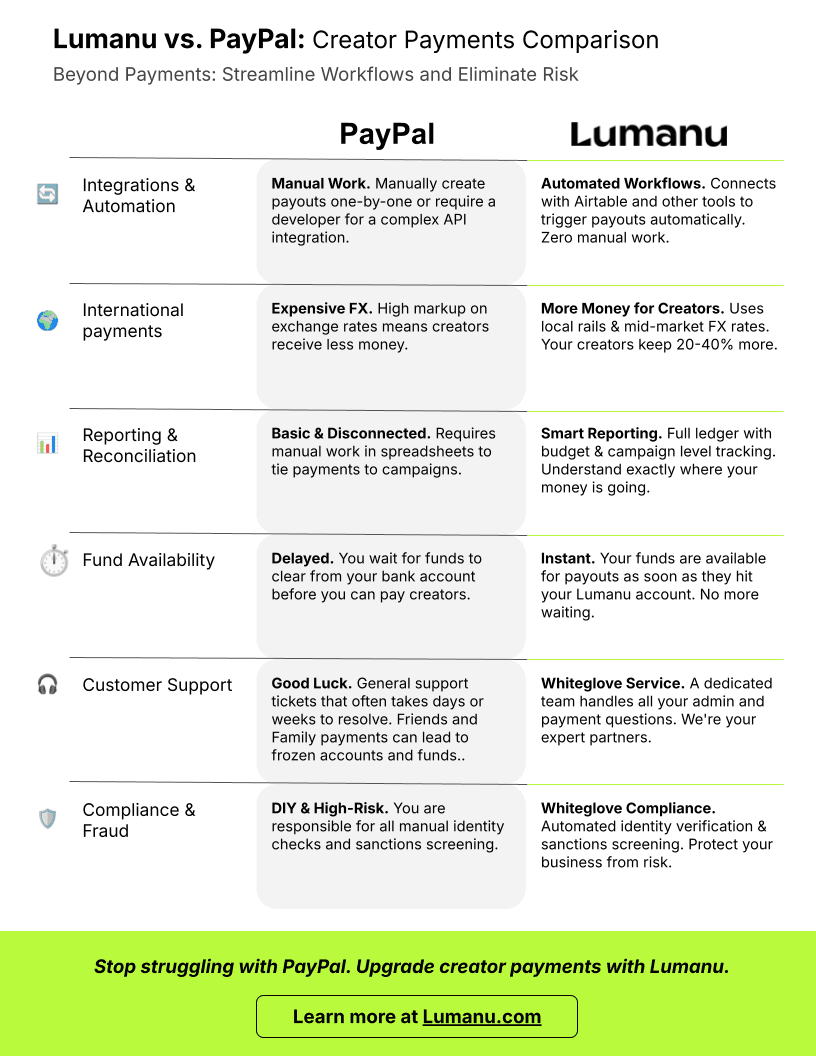

How does Lumanu compare to PayPal?

Lumanu was built specifically for businesses collaborating with creators.

Not only does Lumanu offer additional tools and benefits to help businesses pay creators more smoothly that are not offered by PayPal (e.g. project level budgeting, full ledger reconciliation, dedicated and segregated payment accounts, standard same day ACH, ability to generate and send invoices to your Finance team to fund), but creators can rest assured that accepting money through Lumanu is secure and compliant.

Lumanu improves creator <> brand partnerships by taking all the headaches out of compliance and payments.

Curious how Lumanu supports influencer, affiliate, creator and other 1099 contractor payouts for your business? Request a demo today

Are you a creator?

Lumanu is free for creators. Just accept your brand partner's invite and onboard in minutes!

Updated: December 2025 to include newly published PayPal policies which went into effect on July 16, 2025

As a creator, when you accept payment from your brand partners in exchange for your content and services you are considered a "seller" by PayPal's acceptable use policy. As sellers, creators should never accept payment from their brand partners via the "friends and family" option through PayPal. Accepting payment through the "friends and family" option puts the creator PayPal account and funds at risk of being frozen.

The risk also applies to the payor. Brands and agencies, if you are paying creators using PayPal's 'Friends & Family' method for business expenses you are putting your account along with creator partners at risk. You may also be introducing unforeseen compliance headaches and complicating financial reconciliations or audits. This article explores why this common practice is problematic for everyone involved and what safer, more professional alternatives exist.

What is the “friends and family” payout option vs. the “goods and services” payout option on PayPal?

When your brand partner is electing to send your payment via PayPal, they will have two types of transactions to choose from. Per PayPal’s help center they define the difference between sending money “friends and family” or as “goods and services” as the following:

Sending to a friend and family - used when sending money or a gift card to a friend or family member. Before you complete a payment, you can opt to pay the fee, or pass it onto the recipient to be covered by PayPal Purchase Protection.

Paying for goods or services - used when buying an item or service from someone. When you make a purchase, the seller pays a small fee to receive your money. Your payment is covered by our protection policy automatically.

What are the PayPal Fees associated with “friends and family” vs. “goods or services?”

The friends and family payout method is intended for occasions like sending cash gifts or paying back friends/family members for casual personal purposes. (splitting dinners, splitting hotel costs, etc.)

When paying on credit/debit: 2.9% fee

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money.

When paying from a US bank account: 0% fee

If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Goods and Services “Seller fees”

When sending money for “goods and services”, the “seller” will incur a fee of 2.9% + 30 cents per transaction. The “seller” is the one receiving the money from the “buyer."

Are content creators considered “sellers” on PayPal?

Short answer: Yes.

As an influencer, content creator, or freelancer, when you charge a brand for your services you are considered a “seller” providing a “good or service” to the brand who is considered a “buyer.” Accepting payments when collaborating with brands is considered a commercial transaction.

Why do brand partners request to send payment to creators via the PayPal “friends and family” option?:

The reason why a brand partner may offer to pay a creator via the “friends and family” option instead of the “goods and services” option is simple- it’s free (if the recipient is in the US and the brand is paying from a bank account.)

Per PayPal's fee policy, if a brand were to select to pay a creator via the compliant "goods and services" option, then the creator would be subject to pay the 2.9% +30 cents per transaction seller fee. Some brands may offer to send the money non-compliantly via the "friends and family" to avoid having to cover the fees on behalf of the creator or as an option for the creator to avoid incurring the fees themselves.

What are the risks and penalties of accepting money via the “friends and family” PayPal option?

As Sellers, Creators are held responsible for violating PayPal’s policy:

Using PayPal friends and family for business purchases is explicitly against their User Agreement (under the category of “Restricted Activities -section Af.)

When a brand offers to send the money non-compliantly to pay a creator for their goods and services via the “friends and family” payout option, the brand is not held accountable for the legal liability or penalties for violating PayPal’s terms of service. As the “seller”, the creator is responsible for accepting payment compliantly and would be the party penalized.

Key Details from PayPal's Upcoming User Agreement Update (Effective July 16, 2025):

PayPal has announced updates to its User Agreement, effective July 16, 2025. For creators, the most significant change is a clearer line drawn between personal and business account usage, along with more explicit information on what happens if you're using your personal account for business transactions.

One key takeaway from the updated terms is that if your personal account activity looks like a business, PayPal might force a switch to a business account or close your personal account which can result in frozen funds.

The new user agreement states:

"If the activity associated with your personal account primarily involves business or commercial activity, PayPal may close your account unless you agree to cease the business or commercial activity or convert your personal account to a business account.”

This means continuing to accept payments for your creative work via PayPal 'Friends & Family' is becoming even riskier. These payments are intended for personal gifts and reimbursements, not for business income.

Risk of Banned/Locked Accounts:

The PayPal Enforcement Division team may lock or ban your account if you are suspected of accepting money for goods and services as a seller via the “friends and family” option. PayPal locks accounts that are suspected of violating the terms of services for restricted activities in order to complete an investigation. Even if you are not banned after the investigation is complete, you will be locked out of your account and unable to access your funds for the length of the investigation until PayPal can close the case which can take several months-years to reach a verdict.

Daily limits:

PayPal limits the amount of money a seller can receive to $60,000 per day. Each transaction cannot exceed $10,000. For some creators, being sent money from brand partners that exceed this amount can lead to getting their account locked for investigation.

Lack of Protection and limited ability to resolve disputes:

When accepting money via the friends and family method, PayPal offers does not offer protection or dispute assistance if something were to go wrong with the payment. When sending/accepting money via the “goods and services” option, all transactions are backed by PayPal’s protection program.

To put it simply, according to the article by Moneysavingexpert.com, “A PayPal spokesperson said: "PayPal Buyer Protection does not cover money transfers between friends or family. If someone selling you goods or a service asks you to send a friends and family payment, you should refuse.”

Why Brands and Agencies Should Rethink PayPal F&F for Creator Payments

For brands and agencies dedicated to building strong, professional relationships with creators and maintaining control and visibility over financial operations, how you send payments is an important detail. Relying on PayPal's 'Friends & Family' for business services might seem like an easy workaround, but it goes against PayPal's T&Cs and if you're paying personal accounts from a business account these transactions are likely to be flagged.

Consider the implications:

Frozen Funds: Payments are sent but the creator's account is frozen for weeks and they are unable to actually receive their payment.

Scale: Can your team efficiently manage payments, tax forms, and reporting for dozens or hundreds of creators using a system not purpose built for it?

Compliance: Are you confident that your payment practices meet tax compliance regulations when using informal channels?

Creator Experience: Does your payment process reflect the value you place on your creative collaborators?

Shifting to a payment platform designed for B2B creator payouts not only mitigates these risks but also streamlines your workflow, enhances compliance, and positions your organization as a preferred partner in the creator economy

How does Lumanu compare to PayPal?

Lumanu was built specifically for businesses collaborating with creators.

Not only does Lumanu offer additional tools and benefits to help businesses pay creators more smoothly that are not offered by PayPal (e.g. project level budgeting, full ledger reconciliation, dedicated and segregated payment accounts, standard same day ACH, ability to generate and send invoices to your Finance team to fund), but creators can rest assured that accepting money through Lumanu is secure and compliant.

Lumanu improves creator <> brand partnerships by taking all the headaches out of compliance and payments.

Curious how Lumanu supports influencer, affiliate, creator and other 1099 contractor payouts for your business? Request a demo today

Are you a creator?

Lumanu is free for creators. Just accept your brand partner's invite and onboard in minutes!

Updated: December 2025 to include newly published PayPal policies which went into effect on July 16, 2025

As a creator, when you accept payment from your brand partners in exchange for your content and services you are considered a "seller" by PayPal's acceptable use policy. As sellers, creators should never accept payment from their brand partners via the "friends and family" option through PayPal. Accepting payment through the "friends and family" option puts the creator PayPal account and funds at risk of being frozen.

The risk also applies to the payor. Brands and agencies, if you are paying creators using PayPal's 'Friends & Family' method for business expenses you are putting your account along with creator partners at risk. You may also be introducing unforeseen compliance headaches and complicating financial reconciliations or audits. This article explores why this common practice is problematic for everyone involved and what safer, more professional alternatives exist.

What is the “friends and family” payout option vs. the “goods and services” payout option on PayPal?

When your brand partner is electing to send your payment via PayPal, they will have two types of transactions to choose from. Per PayPal’s help center they define the difference between sending money “friends and family” or as “goods and services” as the following:

Sending to a friend and family - used when sending money or a gift card to a friend or family member. Before you complete a payment, you can opt to pay the fee, or pass it onto the recipient to be covered by PayPal Purchase Protection.

Paying for goods or services - used when buying an item or service from someone. When you make a purchase, the seller pays a small fee to receive your money. Your payment is covered by our protection policy automatically.

What are the PayPal Fees associated with “friends and family” vs. “goods or services?”

The friends and family payout method is intended for occasions like sending cash gifts or paying back friends/family members for casual personal purposes. (splitting dinners, splitting hotel costs, etc.)

When paying on credit/debit: 2.9% fee

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money.

When paying from a US bank account: 0% fee

If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Goods and Services “Seller fees”

When sending money for “goods and services”, the “seller” will incur a fee of 2.9% + 30 cents per transaction. The “seller” is the one receiving the money from the “buyer."

Are content creators considered “sellers” on PayPal?

Short answer: Yes.

As an influencer, content creator, or freelancer, when you charge a brand for your services you are considered a “seller” providing a “good or service” to the brand who is considered a “buyer.” Accepting payments when collaborating with brands is considered a commercial transaction.

Why do brand partners request to send payment to creators via the PayPal “friends and family” option?:

The reason why a brand partner may offer to pay a creator via the “friends and family” option instead of the “goods and services” option is simple- it’s free (if the recipient is in the US and the brand is paying from a bank account.)

Per PayPal's fee policy, if a brand were to select to pay a creator via the compliant "goods and services" option, then the creator would be subject to pay the 2.9% +30 cents per transaction seller fee. Some brands may offer to send the money non-compliantly via the "friends and family" to avoid having to cover the fees on behalf of the creator or as an option for the creator to avoid incurring the fees themselves.

What are the risks and penalties of accepting money via the “friends and family” PayPal option?

As Sellers, Creators are held responsible for violating PayPal’s policy:

Using PayPal friends and family for business purchases is explicitly against their User Agreement (under the category of “Restricted Activities -section Af.)

When a brand offers to send the money non-compliantly to pay a creator for their goods and services via the “friends and family” payout option, the brand is not held accountable for the legal liability or penalties for violating PayPal’s terms of service. As the “seller”, the creator is responsible for accepting payment compliantly and would be the party penalized.

Key Details from PayPal's Upcoming User Agreement Update (Effective July 16, 2025):

PayPal has announced updates to its User Agreement, effective July 16, 2025. For creators, the most significant change is a clearer line drawn between personal and business account usage, along with more explicit information on what happens if you're using your personal account for business transactions.

One key takeaway from the updated terms is that if your personal account activity looks like a business, PayPal might force a switch to a business account or close your personal account which can result in frozen funds.

The new user agreement states:

"If the activity associated with your personal account primarily involves business or commercial activity, PayPal may close your account unless you agree to cease the business or commercial activity or convert your personal account to a business account.”

This means continuing to accept payments for your creative work via PayPal 'Friends & Family' is becoming even riskier. These payments are intended for personal gifts and reimbursements, not for business income.

Risk of Banned/Locked Accounts:

The PayPal Enforcement Division team may lock or ban your account if you are suspected of accepting money for goods and services as a seller via the “friends and family” option. PayPal locks accounts that are suspected of violating the terms of services for restricted activities in order to complete an investigation. Even if you are not banned after the investigation is complete, you will be locked out of your account and unable to access your funds for the length of the investigation until PayPal can close the case which can take several months-years to reach a verdict.

Daily limits:

PayPal limits the amount of money a seller can receive to $60,000 per day. Each transaction cannot exceed $10,000. For some creators, being sent money from brand partners that exceed this amount can lead to getting their account locked for investigation.

Lack of Protection and limited ability to resolve disputes:

When accepting money via the friends and family method, PayPal offers does not offer protection or dispute assistance if something were to go wrong with the payment. When sending/accepting money via the “goods and services” option, all transactions are backed by PayPal’s protection program.

To put it simply, according to the article by Moneysavingexpert.com, “A PayPal spokesperson said: "PayPal Buyer Protection does not cover money transfers between friends or family. If someone selling you goods or a service asks you to send a friends and family payment, you should refuse.”

Why Brands and Agencies Should Rethink PayPal F&F for Creator Payments

For brands and agencies dedicated to building strong, professional relationships with creators and maintaining control and visibility over financial operations, how you send payments is an important detail. Relying on PayPal's 'Friends & Family' for business services might seem like an easy workaround, but it goes against PayPal's T&Cs and if you're paying personal accounts from a business account these transactions are likely to be flagged.

Consider the implications:

Frozen Funds: Payments are sent but the creator's account is frozen for weeks and they are unable to actually receive their payment.

Scale: Can your team efficiently manage payments, tax forms, and reporting for dozens or hundreds of creators using a system not purpose built for it?

Compliance: Are you confident that your payment practices meet tax compliance regulations when using informal channels?

Creator Experience: Does your payment process reflect the value you place on your creative collaborators?

Shifting to a payment platform designed for B2B creator payouts not only mitigates these risks but also streamlines your workflow, enhances compliance, and positions your organization as a preferred partner in the creator economy

How does Lumanu compare to PayPal?

Lumanu was built specifically for businesses collaborating with creators.

Not only does Lumanu offer additional tools and benefits to help businesses pay creators more smoothly that are not offered by PayPal (e.g. project level budgeting, full ledger reconciliation, dedicated and segregated payment accounts, standard same day ACH, ability to generate and send invoices to your Finance team to fund), but creators can rest assured that accepting money through Lumanu is secure and compliant.

Lumanu improves creator <> brand partnerships by taking all the headaches out of compliance and payments.

Curious how Lumanu supports influencer, affiliate, creator and other 1099 contractor payouts for your business? Request a demo today

Are you a creator?

Lumanu is free for creators. Just accept your brand partner's invite and onboard in minutes!

Updated: December 2025 to include newly published PayPal policies which went into effect on July 16, 2025

As a creator, when you accept payment from your brand partners in exchange for your content and services you are considered a "seller" by PayPal's acceptable use policy. As sellers, creators should never accept payment from their brand partners via the "friends and family" option through PayPal. Accepting payment through the "friends and family" option puts the creator PayPal account and funds at risk of being frozen.

The risk also applies to the payor. Brands and agencies, if you are paying creators using PayPal's 'Friends & Family' method for business expenses you are putting your account along with creator partners at risk. You may also be introducing unforeseen compliance headaches and complicating financial reconciliations or audits. This article explores why this common practice is problematic for everyone involved and what safer, more professional alternatives exist.

What is the “friends and family” payout option vs. the “goods and services” payout option on PayPal?

When your brand partner is electing to send your payment via PayPal, they will have two types of transactions to choose from. Per PayPal’s help center they define the difference between sending money “friends and family” or as “goods and services” as the following:

Sending to a friend and family - used when sending money or a gift card to a friend or family member. Before you complete a payment, you can opt to pay the fee, or pass it onto the recipient to be covered by PayPal Purchase Protection.

Paying for goods or services - used when buying an item or service from someone. When you make a purchase, the seller pays a small fee to receive your money. Your payment is covered by our protection policy automatically.

What are the PayPal Fees associated with “friends and family” vs. “goods or services?”

The friends and family payout method is intended for occasions like sending cash gifts or paying back friends/family members for casual personal purposes. (splitting dinners, splitting hotel costs, etc.)

When paying on credit/debit: 2.9% fee

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money.

When paying from a US bank account: 0% fee

If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Goods and Services “Seller fees”

When sending money for “goods and services”, the “seller” will incur a fee of 2.9% + 30 cents per transaction. The “seller” is the one receiving the money from the “buyer."

Are content creators considered “sellers” on PayPal?

Short answer: Yes.

As an influencer, content creator, or freelancer, when you charge a brand for your services you are considered a “seller” providing a “good or service” to the brand who is considered a “buyer.” Accepting payments when collaborating with brands is considered a commercial transaction.

Why do brand partners request to send payment to creators via the PayPal “friends and family” option?:

The reason why a brand partner may offer to pay a creator via the “friends and family” option instead of the “goods and services” option is simple- it’s free (if the recipient is in the US and the brand is paying from a bank account.)

Per PayPal's fee policy, if a brand were to select to pay a creator via the compliant "goods and services" option, then the creator would be subject to pay the 2.9% +30 cents per transaction seller fee. Some brands may offer to send the money non-compliantly via the "friends and family" to avoid having to cover the fees on behalf of the creator or as an option for the creator to avoid incurring the fees themselves.

What are the risks and penalties of accepting money via the “friends and family” PayPal option?

As Sellers, Creators are held responsible for violating PayPal’s policy:

Using PayPal friends and family for business purchases is explicitly against their User Agreement (under the category of “Restricted Activities -section Af.)

When a brand offers to send the money non-compliantly to pay a creator for their goods and services via the “friends and family” payout option, the brand is not held accountable for the legal liability or penalties for violating PayPal’s terms of service. As the “seller”, the creator is responsible for accepting payment compliantly and would be the party penalized.

Key Details from PayPal's Upcoming User Agreement Update (Effective July 16, 2025):

PayPal has announced updates to its User Agreement, effective July 16, 2025. For creators, the most significant change is a clearer line drawn between personal and business account usage, along with more explicit information on what happens if you're using your personal account for business transactions.

One key takeaway from the updated terms is that if your personal account activity looks like a business, PayPal might force a switch to a business account or close your personal account which can result in frozen funds.

The new user agreement states:

"If the activity associated with your personal account primarily involves business or commercial activity, PayPal may close your account unless you agree to cease the business or commercial activity or convert your personal account to a business account.”

This means continuing to accept payments for your creative work via PayPal 'Friends & Family' is becoming even riskier. These payments are intended for personal gifts and reimbursements, not for business income.

Risk of Banned/Locked Accounts:

The PayPal Enforcement Division team may lock or ban your account if you are suspected of accepting money for goods and services as a seller via the “friends and family” option. PayPal locks accounts that are suspected of violating the terms of services for restricted activities in order to complete an investigation. Even if you are not banned after the investigation is complete, you will be locked out of your account and unable to access your funds for the length of the investigation until PayPal can close the case which can take several months-years to reach a verdict.

Daily limits:

PayPal limits the amount of money a seller can receive to $60,000 per day. Each transaction cannot exceed $10,000. For some creators, being sent money from brand partners that exceed this amount can lead to getting their account locked for investigation.

Lack of Protection and limited ability to resolve disputes:

When accepting money via the friends and family method, PayPal offers does not offer protection or dispute assistance if something were to go wrong with the payment. When sending/accepting money via the “goods and services” option, all transactions are backed by PayPal’s protection program.

To put it simply, according to the article by Moneysavingexpert.com, “A PayPal spokesperson said: "PayPal Buyer Protection does not cover money transfers between friends or family. If someone selling you goods or a service asks you to send a friends and family payment, you should refuse.”

Why Brands and Agencies Should Rethink PayPal F&F for Creator Payments

For brands and agencies dedicated to building strong, professional relationships with creators and maintaining control and visibility over financial operations, how you send payments is an important detail. Relying on PayPal's 'Friends & Family' for business services might seem like an easy workaround, but it goes against PayPal's T&Cs and if you're paying personal accounts from a business account these transactions are likely to be flagged.

Consider the implications:

Frozen Funds: Payments are sent but the creator's account is frozen for weeks and they are unable to actually receive their payment.

Scale: Can your team efficiently manage payments, tax forms, and reporting for dozens or hundreds of creators using a system not purpose built for it?

Compliance: Are you confident that your payment practices meet tax compliance regulations when using informal channels?

Creator Experience: Does your payment process reflect the value you place on your creative collaborators?

Shifting to a payment platform designed for B2B creator payouts not only mitigates these risks but also streamlines your workflow, enhances compliance, and positions your organization as a preferred partner in the creator economy

How does Lumanu compare to PayPal?

Lumanu was built specifically for businesses collaborating with creators.

Not only does Lumanu offer additional tools and benefits to help businesses pay creators more smoothly that are not offered by PayPal (e.g. project level budgeting, full ledger reconciliation, dedicated and segregated payment accounts, standard same day ACH, ability to generate and send invoices to your Finance team to fund), but creators can rest assured that accepting money through Lumanu is secure and compliant.

Lumanu improves creator <> brand partnerships by taking all the headaches out of compliance and payments.

Curious how Lumanu supports influencer, affiliate, creator and other 1099 contractor payouts for your business? Request a demo today

Are you a creator?

Lumanu is free for creators. Just accept your brand partner's invite and onboard in minutes!

Updated: December 2025 to include newly published PayPal policies which went into effect on July 16, 2025

As a creator, when you accept payment from your brand partners in exchange for your content and services you are considered a "seller" by PayPal's acceptable use policy. As sellers, creators should never accept payment from their brand partners via the "friends and family" option through PayPal. Accepting payment through the "friends and family" option puts the creator PayPal account and funds at risk of being frozen.

The risk also applies to the payor. Brands and agencies, if you are paying creators using PayPal's 'Friends & Family' method for business expenses you are putting your account along with creator partners at risk. You may also be introducing unforeseen compliance headaches and complicating financial reconciliations or audits. This article explores why this common practice is problematic for everyone involved and what safer, more professional alternatives exist.

What is the “friends and family” payout option vs. the “goods and services” payout option on PayPal?

When your brand partner is electing to send your payment via PayPal, they will have two types of transactions to choose from. Per PayPal’s help center they define the difference between sending money “friends and family” or as “goods and services” as the following:

Sending to a friend and family - used when sending money or a gift card to a friend or family member. Before you complete a payment, you can opt to pay the fee, or pass it onto the recipient to be covered by PayPal Purchase Protection.

Paying for goods or services - used when buying an item or service from someone. When you make a purchase, the seller pays a small fee to receive your money. Your payment is covered by our protection policy automatically.

What are the PayPal Fees associated with “friends and family” vs. “goods or services?”

The friends and family payout method is intended for occasions like sending cash gifts or paying back friends/family members for casual personal purposes. (splitting dinners, splitting hotel costs, etc.)

When paying on credit/debit: 2.9% fee

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money.

When paying from a US bank account: 0% fee

If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Goods and Services “Seller fees”

When sending money for “goods and services”, the “seller” will incur a fee of 2.9% + 30 cents per transaction. The “seller” is the one receiving the money from the “buyer."

Are content creators considered “sellers” on PayPal?

Short answer: Yes.

As an influencer, content creator, or freelancer, when you charge a brand for your services you are considered a “seller” providing a “good or service” to the brand who is considered a “buyer.” Accepting payments when collaborating with brands is considered a commercial transaction.

Why do brand partners request to send payment to creators via the PayPal “friends and family” option?:

The reason why a brand partner may offer to pay a creator via the “friends and family” option instead of the “goods and services” option is simple- it’s free (if the recipient is in the US and the brand is paying from a bank account.)

Per PayPal's fee policy, if a brand were to select to pay a creator via the compliant "goods and services" option, then the creator would be subject to pay the 2.9% +30 cents per transaction seller fee. Some brands may offer to send the money non-compliantly via the "friends and family" to avoid having to cover the fees on behalf of the creator or as an option for the creator to avoid incurring the fees themselves.

What are the risks and penalties of accepting money via the “friends and family” PayPal option?

As Sellers, Creators are held responsible for violating PayPal’s policy:

Using PayPal friends and family for business purchases is explicitly against their User Agreement (under the category of “Restricted Activities -section Af.)

When a brand offers to send the money non-compliantly to pay a creator for their goods and services via the “friends and family” payout option, the brand is not held accountable for the legal liability or penalties for violating PayPal’s terms of service. As the “seller”, the creator is responsible for accepting payment compliantly and would be the party penalized.

Key Details from PayPal's Upcoming User Agreement Update (Effective July 16, 2025):

PayPal has announced updates to its User Agreement, effective July 16, 2025. For creators, the most significant change is a clearer line drawn between personal and business account usage, along with more explicit information on what happens if you're using your personal account for business transactions.

One key takeaway from the updated terms is that if your personal account activity looks like a business, PayPal might force a switch to a business account or close your personal account which can result in frozen funds.

The new user agreement states:

"If the activity associated with your personal account primarily involves business or commercial activity, PayPal may close your account unless you agree to cease the business or commercial activity or convert your personal account to a business account.”

This means continuing to accept payments for your creative work via PayPal 'Friends & Family' is becoming even riskier. These payments are intended for personal gifts and reimbursements, not for business income.

Risk of Banned/Locked Accounts:

The PayPal Enforcement Division team may lock or ban your account if you are suspected of accepting money for goods and services as a seller via the “friends and family” option. PayPal locks accounts that are suspected of violating the terms of services for restricted activities in order to complete an investigation. Even if you are not banned after the investigation is complete, you will be locked out of your account and unable to access your funds for the length of the investigation until PayPal can close the case which can take several months-years to reach a verdict.

Daily limits:

PayPal limits the amount of money a seller can receive to $60,000 per day. Each transaction cannot exceed $10,000. For some creators, being sent money from brand partners that exceed this amount can lead to getting their account locked for investigation.

Lack of Protection and limited ability to resolve disputes:

When accepting money via the friends and family method, PayPal offers does not offer protection or dispute assistance if something were to go wrong with the payment. When sending/accepting money via the “goods and services” option, all transactions are backed by PayPal’s protection program.

To put it simply, according to the article by Moneysavingexpert.com, “A PayPal spokesperson said: "PayPal Buyer Protection does not cover money transfers between friends or family. If someone selling you goods or a service asks you to send a friends and family payment, you should refuse.”

Why Brands and Agencies Should Rethink PayPal F&F for Creator Payments

For brands and agencies dedicated to building strong, professional relationships with creators and maintaining control and visibility over financial operations, how you send payments is an important detail. Relying on PayPal's 'Friends & Family' for business services might seem like an easy workaround, but it goes against PayPal's T&Cs and if you're paying personal accounts from a business account these transactions are likely to be flagged.

Consider the implications:

Frozen Funds: Payments are sent but the creator's account is frozen for weeks and they are unable to actually receive their payment.

Scale: Can your team efficiently manage payments, tax forms, and reporting for dozens or hundreds of creators using a system not purpose built for it?

Compliance: Are you confident that your payment practices meet tax compliance regulations when using informal channels?

Creator Experience: Does your payment process reflect the value you place on your creative collaborators?

Shifting to a payment platform designed for B2B creator payouts not only mitigates these risks but also streamlines your workflow, enhances compliance, and positions your organization as a preferred partner in the creator economy

How does Lumanu compare to PayPal?

Lumanu was built specifically for businesses collaborating with creators.

Not only does Lumanu offer additional tools and benefits to help businesses pay creators more smoothly that are not offered by PayPal (e.g. project level budgeting, full ledger reconciliation, dedicated and segregated payment accounts, standard same day ACH, ability to generate and send invoices to your Finance team to fund), but creators can rest assured that accepting money through Lumanu is secure and compliant.

Lumanu improves creator <> brand partnerships by taking all the headaches out of compliance and payments.

Curious how Lumanu supports influencer, affiliate, creator and other 1099 contractor payouts for your business? Request a demo today

Are you a creator?

Lumanu is free for creators. Just accept your brand partner's invite and onboard in minutes!

By

Kam Thandi

Oct 18, 2025

Platform

Solutions

By Role

By use case

By BUSINESS TYPE

© 2025 Lumanu, Inc. All Rights Reserved.

Platform

Solutions

By Role

By use case

By BUSINESS TYPE

© 2025 Lumanu, Inc. All Rights Reserved.

Platform

Solutions

By Role

By use case

By BUSINESS TYPE

© 2025 Lumanu, Inc. All Rights Reserved.

Platform

Solutions

By Role

By use case

By BUSINESS TYPE

© 2025 Lumanu, Inc. All Rights Reserved.